Happy Holidays! Year-End Tax Saving Tips to Spend or Save for the Holidays

It looks like the end of the year is coming, and we are pretty sure many of you are still frantically shopping for gifts for your family and friends. Do you ever wish you had more money to spend for your friends and family, but just could not figure out how you can save more money?

Well have no fear! We are an Orange County CPA firm who will be here to provide tips on how you can cut tax spending to save or have more money to spend for you your loved ones.

Capital Gains and Dividends. The tax rate on qualified capital gains (net-long term gains) and dividends range from 0 – 20%, depending on the individuals income tax bracket.

STRATEGY: Spikes in income, whether capital gain or other income, may push gains into either the 39.6 percent bracket for short-term gain or the 20% capital gains bracket. Spending the recognition of certain income between 2016 and 2017 may help minimize the total tax paid for the 2016 and 2017 tax years.

State and local sales tax deduction. The PATH Act made permanent the itemized deduction for state and local general sales taxes. That deduction may be taken in lieu of state and local income taxes when itemizing deductions.

STRATEGY: Generally IRS tables based upon federal income levels and a taxpayer’s number of departments are used for this optimal deduction. Taxpayers who wish to claim more than the table amounts must provide adequate substantiation.

Tuition and fees deduction. The PATH Act extended the above-the-line deduction for qualified tuition and related expenses for two years, for expenses paid before January 1, 2017. The maximum amount of the tuition and fees deduction is $4,000 for an individual whose AGI (Adjusted Gross Income) for the tax year does not exceed $65,000 ($130,000 in the case of a joint return), or $2000 for other individuals who’s AGI does not exceed $80,000 ($160,000 in the case of a joint return)

STRATEGY: Payments by year-end 2016 may be particularly critical to taking this deduction. There is some – but not unlimited – flexibility regarding the deductibility of tuition paid before a semester begins. As with the AOTC, the deduction is allowed for expenses paid during a tax year, in connection with an academic term beginning during the year or the first three months of the next year.

Nonbusiness energy property credit. The PATH Act extended the nonrefundable non business energy property credit allowed to individuals, making it available or qualified energy improvements and property placed in service before January 1, 2017.

STRATEGY: Several overall limitations apply. A credit amount for qualified energy efficiency improvements equals 10 percent of the amount paid or incurred during the tax year and 100% of the amount paid or incurred for qualified energy property during the tax year. The maximum credit amount for qualified energy property varies depending on the type of property, further all nonbusiness energy property carries a $500 maximum lifetime credit cap.

Individual Shared Responsibility Payments. For 2016, the individual shared responsibility payment is the greater of 2.5% of house-hold income that is above the tax return filing threshold for the individual’s filing status or the individual’s flat dollar amount, which is $695 per adult and 347.50 per child, limited to a family maximum of $2,085, but capped at the cost of the national average premium for a bronze level health plan available through the Marketplace in 2016.

STRATEGY: Open enrollment for coverage through the Health Insurance Marketplace for 2016 has closed. However, some qualifying life events may make an individual eligible for non-filing season special enrollment.

Medical expense deduction. Taxpayers who itemized deductions (for regular tax purposes) may claim a deduction for qualified reimbursed medical expenses to the extent those expenses exceed 10% of adjusted gross income (AGI), unless the tax payer falls within an age-based exception. Taxpayers (or their spouses) who are aged 65 or older before the close of the tax year, may apply the old 7.5% threshold for tax years but only through 2016.

STRATEGY: Tax payers who are age 65 or older may consider accelerating medical costs into 2016 if they want to itemize deductions since the AGI floor for deductible expense rise from 7.5% to 10% in 2017. For deductions by cash-basis taxpayers in general, including for purposes of the medical expense deduction, a deduction is permitted only in the year in which payment for services rendered is actually made.

A Smart Business Decision Maker = A Successful Entrepreneur

December 19, 2016 by admin

Filed under Entrepreneurship

Many successful business leaders all share a common skill that most people do not posses. Although this skill comes in all forms and is dependent on the amount of opportunities given to them, they all still have to undergo a process whether it takes a long time to process or a very short amount of time. That skill, my fellow entrepreneurs is: Smart Business Decision-making. Every day people from all over the world make decisions. You may not realize it but you, the reader, just made the decision to read this article (Thanks by the way!). However, let’s take it to a business perspective; business leaders, (including yourself) “make dozen of decisions a day” that creates an impact to the success of their company while creating an influence factor to employees as well. “Developing such a skill requires a combination of education, experience, and intuition.”

Marci Martin, author of Business News Daily who wrote the article “How to Make Effective Business Decisions” has stated a great quote: “There are many things that influence how an individual makes decisions. They include emotions, perceived personal and professional risks and rewards, preparation through experience or education, deadlines, stress and a host of others. It is important to mitigate the irrational and embrace the rational.”

Many decisions always comes with a process, as mentioned above, there are many factors that come into play before coming up with a conclusion. Some of those decisions usually come from a “gut feeling” while others come from undergoing a long process of asking others, and a more common form would be the opportunity cost (Is it more beneficial to me than the cost?). As Martin mentioned, the “bottom line is that being an effective decision-maker requires practice.”

Gayle Abott, President of Strategic Alignment Partners, a human consulting firm, has implemented a four- point strategy to deploy whenever you must act:

– Identify the problem.

– Analyze the possible solutions

– Evaluate the possibilities that are likely to bring you closer to your goal.

– Make the decision.

However, as easy as this 4 point system sounds, this type of strategy does not come easily for any beginner. As Abott has said in Business News Daily, it takes years of practice to master this skill. Many people who have become masters did not simply start off as talented decision makers, they made many mistakes in the past, learned from them, and simply moved on. The most crucial part in any decision making in a business, is the ability to learn from them. It is not easy as you think it is because people still make the same mistake, whether it’d be motivated by an emotion, by influence, or by stubbornness. The reality is that, it will not be easy to become a smart business decision maker until you have made enough decisions to consider yourself a smart business decision maker.

How to Deal with Stress of Running a Business

December 7, 2016 by admin

Filed under Entrepreneurship

Are you a business owner who has been through a lot of stress these past couple months? Especially, when tax season is coming and you have no one to prepare your tax forms for you? Well, let us take a moment to tell you that, if you are reading this blog post right now, you are probably looking for someone to prepare your tax returns or looking for a CPA accountant who can do that work for you. In fact, we are a CPA firm in case you haven’t noticed!

Anyway, this blog post is not about how to hire an Orange County CPA, the main point of this blog is to talk about how to deal with stress when running a business. So how can you deal with it? According to Pratik Dholakiya, Co-Founder of E2M, he wrote an article called 3 Tactics for Dealing With the Stress of Running a Business, which talks about dealing with stress and said that an entrepreneur is always required to be involved in every activity that their business is undergoing, always taking on new challenges, and creating bonds and relationships while learning on the go. Of course, as Pratik mentioned, will be overwhelming, which is something that most entrepreneurs face.

Pratik listed out three powerful ways to fight against this overwhelming stress that will keep you on track with your business goals without going insane.

1) Create a priority list, and list all of your goals in a list from most important to least important.

Sounds easy right? It is! If you actually take the time to do it. The overwhelming amount of work you have to do is actually not that bad if you know how to prioritize and focus through them on the entire day. Keep a list of priorities and keep a list of dates to make sure when to start on those, and when the deadline is for each of them. This is very important, as this will keep your mind organized, and you can keep a simple focused mindset without going off in a tangent. Complete the task that is most important, and then once that is complete, move on to the next one and complete that one, and keep going through them all until you have completed them all. If you have a reoccurring event that constantly needs to be taken care of, always keep that task in your list.

2) Relax and clear your mind before you go to bed, go back into work mode the next morning.

Of course, every night, we all feel like we have so much information in our heads that we just want to explode. The endless thinking is killing us all, and we just want to keep thinking. Do not try to fight through this complicated matter, instead, clear your mind, and then set yourself up to think about first thing tomorrow morning. You will feel refreshed the first thing in the morning, and your decision making will be better than yesterday’s.

3) Analyze and reassess your circle of control

Pratik explains how we should focus our energies on things that are directly in our control and how we should not be drawn to things where we have little to no influence over. He makes a good point about how most entrepreneurs start with a great idea of what their circle of control has, but as time progresses and they meet new business people, the circle will consistently change. Depending on the entrepreneur, the circle will either shrink or it will grow. The point is, it will not stay the same, it is always changing, so it would be wise to consistently, evaluate your circle of control. “When you are feeling hammered, and are struggling to keep yourself sane in the middle of your fast-growing business, it’s a good idea to take a step back and ask yourself, how much of that which you are contending with do you actually control?” (Dholakiya)

This Skill is What Determines the Success of Your Business

December 5, 2016 by admin

Filed under Entrepreneurship

Just recently, there was an article written by Matt Fore who talked about an important skill that would subsequently determine the success of your business. In his article, he provided an example from his experience about one of his business friends and talked about this important skill that he was lacking, and how it failed to bring him to the path of financial success.

The story unfolds to talk about a man named Earl who was a business man and a magician who performed amazingly for audiences such as adults and families. In fact, his talent was so good, that he was comparable to Houdin Thurstonfield, however, given his talents, he could not generate enough viewers to come to his magic show. Although his talents were astonishing and jaw-dropping, he lacked this important skill needed to get a business of his magic show going.

Do you know what skill he is lacking?

If you guessed Communications, you are certainly correct!

The most important skill that determines the life of a business is communication. Many Orange County CPA Firms and Entrepreneurs including Matt Fore will tell you that “An effective marketing campaign should stir a response; it should stir a conversation. It should give a compelling reason for the client to reach out and receive a benefit.” (Fore)

Communication is very important in business because it plays a fundamental role in all the factors of business. The internal part of your business, which is yourself and the partner/employees are crucial because communicating effectively within your business organization will efficiently complete short term goals and possibly long term goals. Additionally, you want to make sure that your external communication is also well trained, for example your consumers. How are they receiving the messages that you send out to them? Compare what you see and what they see in your advertisements, are you both in the same page?

Another thing to note too is that communication builds and maintains relationships, communication is very important because you want all your business partners to understand your situation, your goals, and any other factor that your partners may want to know. A CPA firm typically asks for effective communication. In fact, it is practically required that you have effective communication skills, otherwise, your CPA will not be able to get the job done correctly if you don’t!

So there you have it, communication. Remember to always have a good mindset and make sure to always answer any questions if needed from your fellow business partners or consumers.

***ARTICLE BASED OFF OF MATT FORE OF ENTREPRENEUR.COM***

How Hard is it to Invest in Real Estate?

December 1, 2016 by admin

Filed under Entrepreneurship

There was an interesting article written by Scott Trench who recently wrote an article about how easy it is to invest in Real Estate. In the beginning he talks about how some of the most successful entrepreneurs started off with nothing. That’s a very typical story of how entrepreneur’s become millionaires. Many of us has read many stories about these successful people, but what about working class or middle class people?

In this article, he personally talks about how he was able to achieve his financial freedom through gradual investment of real estate while working his full time job that he personally loves, while making medium to medium high income. It is true that most people would love to live that kind of lifestyle of being able to make additional money on the side while making money from their jobs that they love. That is the dream! However, later in the article he talks in detail about how every single investment always has a risk, which is true! Any investment always comes with risk, no matter how big or small. Additionally, there is some commitment involved, which is one of the reasons most people could not leave their jobs to pursue an investment journey to reach financial freedom.

At the end of the article, Trench states that real estate investing does not have to be so hard. Although there are some instances where it is easy if you make it to be. There are a few considerations to think about before you get into investing property.

The Good, Bad, and Ugly of Real Estate Investments states that knowing your market well would be beneficial. Looking for deals that are underpriced for one reason or another would be a good idea, because you won’t know which deals are underpriced unless you have a good sense of how properties are priced.

And another problem that you may have to consider is who the tenants are. There are some stories where tenants would bring in stolen merchandise into the property and store them in there. Another instance would be, party goers, they may wreck your property which will incur many costs and repairs, which will cost more than what you are earning from them for rental payment. And another is when tenants treat your property like its theirs, painting the homes, adding unnecessary items to the home that stays in the home etc. Lesson here is to make sure to check your tenants on a frequent basis.

Overall, investing can be easy, but always remember to consider some of these facts as they can be very helpful in your future obstacles that you may face when you invest in real estate.

**Article Based on Biggerpockets.com**

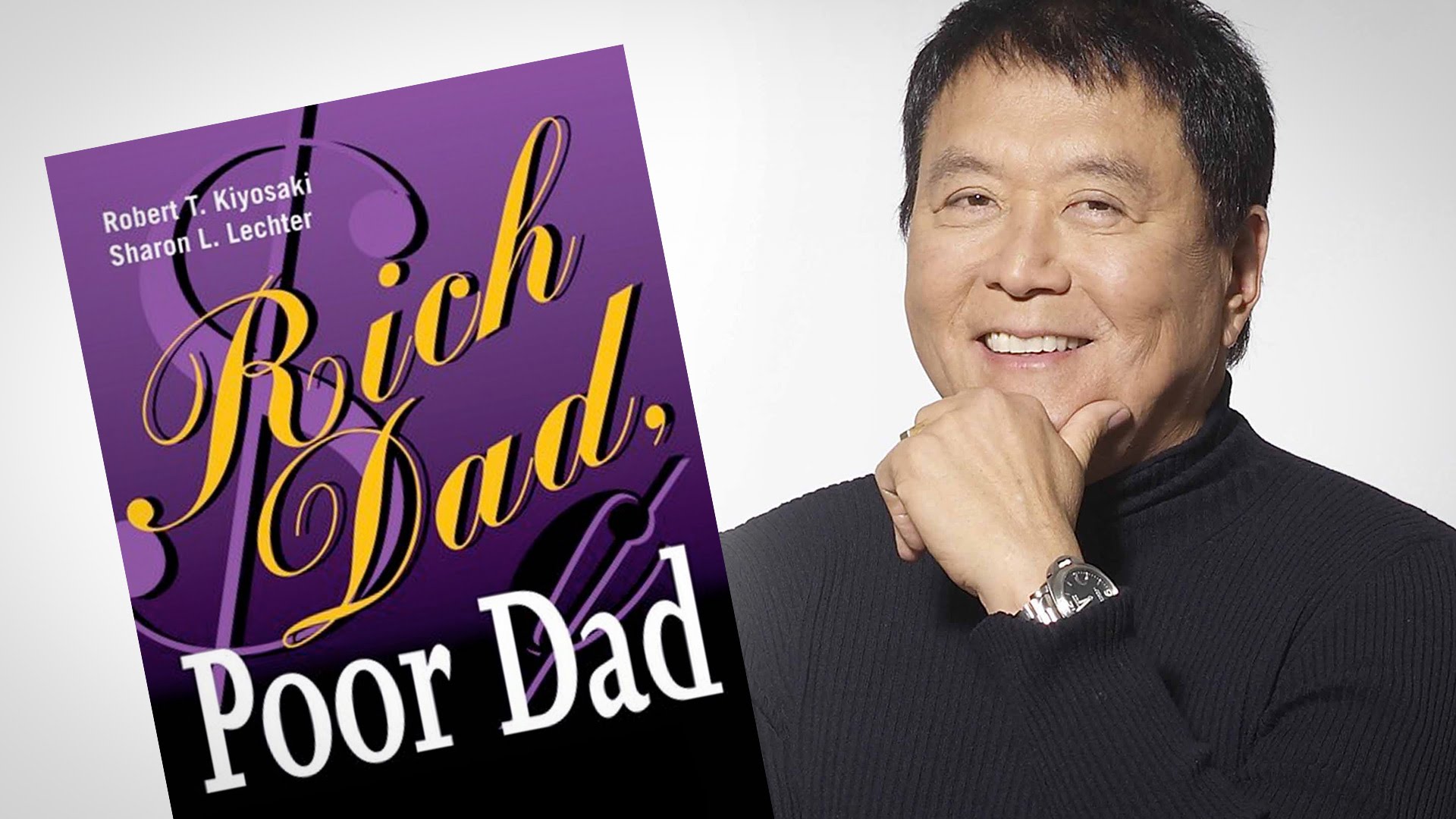

The Lesson from Rich Dad, Poor Dad

November 28, 2016 by admin

Filed under Entrepreneurship

“Many people work very hard, but they never seem to earn enough. In Rich Dad, Poor Dad, Robert Kiyosaki explains how to escape this “rat race” and achieve financial independence.”

When you are trying to aim for financial independence, people would think that going to school getting high grades and getting a good job would be the answer to all your financial problems right? Well, if you think that’s the way to go, then you probably shouldn’t be reading this. Just kidding! It’s just a sarcastic comment. According to Rich Dad, Poor Dad, Robert Kiyosaki claims that the education system is the number one cause of why so many people struggle financially. Schools teach people how to work for money, but they do not teach them how money can work for them. For example, Orange County is one of the richest counties in United States and yet many people within that county are not really good at handling their money to a certain extent, that is why they look for Orange County CPA firms and depend on them to manage their money. Although Orange County CPA firms are very useful and helpful, the lack of financial skills taught in school for these people means that even highly educated people generally do not know how to handle their money. The results are that the majority of people are trapped in work to pay their bills and are chasing paychecks all their life.

Unfortunately, Robert Kiyosaki claims this as his sad conclusion. Luckily, he also offers a way out of this loop. The essential element with working for money is that a job is a short term solution to a long term problem. People strongly believe that if they get a promotion or a raise, or get a new job, they will finally have enough to live financially. However, if you do not know how money works, you can never have enough money alone will not solve anything. It will even get most people into more debt. So what is the secret to financial independence?

The secret is actually quite simple: “Know what an asset is, acquire them and become rich.” (Kiyosaki) Sounds easy right? Heres the hard part though, most people are not appropriately taught how to spend their money. Many do you not know the difference between an asset, which is something that puts money in your pocket, and a liability, which is something that takes money out of your pocket. Kyosaki’s main point is that the only way to become financially independent is to accumulate income generating assets which can pay for your expenses. Unfortunately, many people would rather buy a new car or a phone instead of investing their money in stocks or real estate.

If you do not want money to control you like it does most people, then you will have to do things differently from the crowd.

We would highly recommend reading Robert Kiyosaki’s book Rich Dad, Poor Dad, it is very interesting, gives you a different perspective in life, and it is very educational.

***ARTICLE BASED ON VALUESPREADSHEET.COM WRITTEN BY NICK KRAAKMAN***

9 Things Every Business Owner Should Know

November 18, 2016 by admin

Filed under Entrepreneurship

Always Remember. Cash is king :

Cash crunches happen from time to time, but if they are chronic at your company, then you may have to re-think the way you do business. Though cash-flow squeezes often seem satisfying, there are only a few explanations. Your gross margins may be too low, caused by discounted prices or out-of-control direct costs. Your overhead, including rent and payroll, may be too high. Your payment terms may be too liberal or your billing procedures too slack. You may be tying too much money up in accounts receivable or you have too much debt from nonpaying customers. Finally, it is also possible that you are holding too much inventory. If you feel tight on cash, investigate on each of these possibilities and figure out which one is causing the biggest drain on your bank account.

Cash may be king, but its not everything:

A business and the person who owns it, can have a material impact on the world well beyond the dollars attached to it. So, money aside, it is important to have a mission, and stick to it.

Systems can be humane:

Nick Sarillo of Nick’s Pizza & Pub in suburban Chicago has built his company’s cutlure by using a form of management that we dubbed “trust and track.” The system defines the basic tasks of the business down to the letter, then trusts workers to consult lists of directions in order to complete these tasks. Sequences are mapped out, but particular duties are not assigned. Workers are expected to take initiative. “Managers trained in command and control think it’s their responsibility to tell people what to do,” Sarillo says. “They like having that power. It gives them their sense of self-worth. But when you manage that way , people see it, and they start waiting for you to tell them what to do. You wind up with too much on your plate, and things fall through the cracks. It is not efficient or effective.

Character is key when hiring new employees:

In many companies, the person who talks the best usually gets the job. But CEO of Whole Foods John Mackey views the skills to look for in a job candidate, especially for a leadership position, has evolved over the years as he has seen confident, fluent employees over the years as he has seen confident, fluent employees fall short on the merits of their work. Now, he looks for character over communication skills, and tries to promote from within as much as possible.

Culture Matters:

Zappos CEO Tony Hsieh build his company into an exemplar of great service by first figuring out what he needed to do to treat his employees well. The answer is quite simple: Plenty of individuality and autonomy, a pride in human weirdness, cheers and off-hours fraternizing and figuring out how to weed out half-hearted employees before they bring everybody else down.

Working with partners is easier said than done:

A strategic or joint-venture partner can help your company enter new lines of business, and expand at a more rapid clip than you could otherwise. But partnerships are tricky to manage. Make sure you research the reputations of potential partners with care, establish both the big-picture objective of a deal as well as the nitty-gritty who knows what, identify your champion within the other organization, and put in writing a mechanism for ending the partnership amicably.

The best salespeople thrive on rejection:

G.Clotaire Rapaille, a psychoanalyst and ethnographer who lives in Florida, has studied salespeople and finds that the best are those who are somewhat thrilled by rejection. He calls them: happy losers. What makes a good salesperson is that these rejections didn’t make them want to give up. It made them want to find another way. Among the other virtues of happy losers: They try more techniques, they improvise, they take “chances” and they don’t believe a sale closes with a yes.

Knowing how to control clients is an art:

One of the greatest gifts for entrepreneurs to have is having the ability to say the word no. Learning the word no and then really have the energy and the experience and the knowledge to sit your client down and tell them not to do something is difficult. You have to be like a good trekker going through Nepal.

You need to leave yourself time to dream:

An entrepreneur is, by definition, a creative person. But as your company grows, you are likely to get dragged away from the most innovative, idea-driven parts of your business. Don’t let that happen, at least not without a fight. Build time into each day to think about your company’s vision, to brainstorm new products, to read for pleasure, or simply to muse about things that might not matter much. Staying creative is among the healthiest things a CEO can do personally and for the company.

***ARTICLE BASED ON Inc. Staff’s ARTICLE: 15 Things Every Business Owner Should Know, FROM Inc.om***

8 Things Entrepreneurs Do Differently

November 16, 2016 by admin

Filed under Business News

Entrepreneurship goes beyond Elon Musk and Mark Zuckerberg. It is mostly an approach to life that favors creativity over conformity and action over inaction. Author and investor, James Altucher says that “Being an entrepreneur doesn’t mean starting the next Facebook.” Or even starting any business at all. It means finding the challenges you have in your life, and determining creative ways to overcome those challenges. It means finding the challenges you have in your life, and determining creative ways to overcome those challenges.”

So even if you’re not tinkering away at the next world-changing invention or looking to set up shop in Silicon Valley, there are aspect to the entrepreneurial mindset that will enrich your work and life. Here are 8 things entrepreneurial people do differently.

– They’re brave enough to commit to their dreams.

- Entrepreneurs choose to forego the security and familiarity of a ‘regular job’ to live an uncertain and insecure lifestyle. It takes a lot of bravery to make that tradeoff, but for icons like Walt Disney, the potential reward is worth it.

– They think of their customers more than themselves.

- Entrepreneurs are rarely out to seek fame for themselves. Instead, they’re more concerned with the people they want to help or the problem they want to solve. This infuses their task with a layer of meaning that can be the difference between success and failure when things get tough. A quote said by Guy Kawasaki: “In your darkest, most frustrated hours, remember the value you are trying to add to peoples’ lives, the satisfaction you’ll feel, or the cause that you’ll further.”

– They never stop learning.

- Since they’re in the business of creating new products and inventing new ways of doing things, much of what entrepreneurs do can’t be taught in a classroom. They know that the most important lessons are learned through living, so throughout their lives, they remain open, flexible, and curious in order to absorb as much as possible.

– They never give up.

- Rarely does an inventor or entrepreneur success on the first try. To create something lasting and worthwhile, it usually takes years of hard work, focus, and dedication. An idea is just a starting point. Persistence is a critical element of entrepreneurship.

– They love failing.

- For most people, the fear of failure is entirely paralyzing, but for entrepreneurs, failure is something to embrace. It’s an indication of pushing the limits, and inevitable when one is constantly trying new things.

– They find and fill a need of the world.

- Entrepreneurs want to do more than indulge their own interests – they want to solve a problem or create a product that satisfies a need. Some started businesses because of frustration with an inefficient or defective system. Others were moved by a personal encounter with poverty or misfortune.

– They take old ideas and make them way, way better.

- While one might think that entrepreneurs are focused mainly on never-seen-before ideas, they often revamp an existing model or upgrade an outdated product. Sometimes, these reinvented ideas change the way we exercise, read, or eat.

– Above all, they act.

- Entrepreneurs execute when for many others, an idea simply fades into the past. They are masters of turning abstract into the concrete. This seemingly simple action is one of the great challenges of life and in the end, it’s what defines an entrepreneur.

***ARTICLE WRITTEN BY JOE VAN BRUSSEL OF HUFFINGTONPOST.COM***

2016 Post-Election Tax Update

November 15, 2016 by admin

Filed under Business News, Tax News

Any change in Presidential Administration brings the possibility, indeed the likelihood, of tax law changes and the election of Donald Trump as the 45th President of the United States is no exception. During the campaign, President-elect Trump outlined a number of tax proposals for individuals and businesses. This letter highlights some of the President-elect’s tax proposals. Keep in mind that a candidate’s proposals can, and often do, change over the course of a campaign and also after taking office. This letter is based on general tax proposals made by the President-elect during the campaign and is intended to give a broad-brush snapshot of those proposals.

At the same time, the end of the year may bring some tax law changes before President Obama leaves office. This letter also highlights some of those possible changes with an eye on how late tax legislation could impact your year-end tax planning.

Campaign proposals

During the campaign, President-elect Trump called for reducing the number of individual income tax rates, lowering the individual income tax rates for most taxpayers, lowering the corporate tax rate, creating new tax incentives, and repealing the Affordable Care Act (ACA) (including presumably the ACA’s tax-related provisions). The President-elect, in his campaign materials, highlighted several goals of tax reform:

- —Tax relief for middle class Americans

- —Simplify the Tax Code

- —Grow the American economy

- —Do not add to the debt or deficit

President-elect Trump also identified during the campaign a number of tax-related proposals that he intends to pursue during his first 100 days in office:

- —The Middle Class Tax Relief and Simplification Act: According to Trump, the legislation would provide middle class families with two children a 35 percent tax cut and lower the “business tax rate” from 35 percent to 15 percent.

- —Affordable Childcare and Eldercare Act: A proposal described by Trump during the campaign that would allow individuals to deduct childcare and elder care from their taxes, incentivize employers to provide on-site childcare and create tax-free savings accounts for children and elderly dependents.

- —Repeal and Replace Obamacare Act: A proposal made by Trump during the campaign to fully repeal the ACA.

- —American Energy & Infrastructure Act: A proposal described by Trump during the campaign that “leverages public-private partnerships, and private investments through tax incentives, to spur $1 trillion in infrastructure investment over 10 years.”

Individual income taxes

The last change to the individual income tax rates was in the American Taxpayer Relief Act of 2012 (ATRA), which raised the top individual income tax rate. Under ATRA, the current individual income tax rates are 10, 15, 25, 28, 33, 35, and 39.6 percent. During the campaign, President-elect Trump proposed a new rate structure of 12, 25 and 33 percent:

- —Current rates of 10 percent and 15 percent = 12 percent under new rate structure.

- —Current rates of 25 percent and 28 percent = 25 percent under new rate structure.

- —Current rates of 33 percent, 35 percent and 39.6 percent = 33 percent under new rate structure.

This rate structure mirrors one proposed by House Republicans earlier this year. During the campaign, President-elect Trump did not detail the precise income levels within which each bracket percentage would fall, instead generally estimating for joint returns a 12-percent rate on income up to $75,000; a 25-percent rate for income between $75,000 and $225,000; and 33 percent on income more than $225,000 (brackets for single filers will be half those dollar amounts) and “low-income Americans” would have a 0-percent rate. As further details emerge, our office will keep you posted.

Closely-related to the individual income tax rates are the capital gains and dividend tax rates. The current capital gains rate structure, imposed based upon income tax brackets, would presumably be re-aligned to fit within President-elect Trump’s proposed percent income tax bracket levels.

10 Steps to Survive a Business Disaster

November 15, 2016 by admin

Filed under Uncategorized

In business, it sometimes pays to take a risk. But in the face of natural disasters, like floods and fires, or criminal activity like cyber hacking, your Recovery Procedure Plan needs to be as safe as houses. After all, everything is on the line.

The PwC’s recent Global Economic Crime Survey makes for scary reading. While reporting that over half of British businesses will suffer cyber-attacks by 2018, a third of UK organisations admit that they have no response plan in place to protect themselves. Don’t gamble your company’s future and your livelihood unnecessarily.

Follow these 10 simple steps to survive any business disaster that might come your way.

1. Plan for anticipated disasters

Thinking ahead will make the difference between continuing trading and closing down. Managing Directors must assemble a Recovery Team and a Business Continuity Plan, to put into action should the worst happen.

2. Raise the alarm

Notify the Managing Director and their Deputy the minute a disaster strikes, no matter how big or small you think the issue is.

3. On arrival at the site

a) Determine the extent of the crisis

b) If necessary liaise with the emergency services

c) Notify the ‘next of kin’ of any casualties

d) Estimate the likely business interruption

4. Call out your Crisis Team

a) Brief your Crisis Team

b) Agree the potential impact

c) Reaffirm and allocate responsibilities, then start the recovery process

5. Notify absent staff

a) Tell everyone that there has been an incident

b) Explain what action is being undertaken

c) Convey any instructions and requests

6. Keep your business functioning

a) Assess the damage

b) Advise all suppliers, customers, and your utility providers of new arrangements and any changes

c) Notify insurance brokers and financial partners, then agree any requirements

7. Rebuild your business essentials

a) Complete an Event Log throughout your recovery process, detailing the actions taken and by whom

b) Retrieve all backups to enable recovery

c) Inform all staff of your progress

d) Arrange payment of salaries for appropriate staff

e) Make arrangements for people to work from home if needed, communications, temporary premises, and re-occupying your building

8. Arrange necessary installations and communications

a) Order any replacement machinery and equipment needed in your new facility

b) Install new machinery, equipment, utilities, communications, furniture, electrical layouts

c) Update contractors

d) Update safety documents and business continuity plans

e) Estimate the time for reoccupying permanent facilities and maintain communications with customers

f) Arrange for installation of equipment and machinery from your temporary location into the permanent facility

g) Switch telephone numbers back to permanent facility

h) Inform customers, suppliers, utilities, your financial team and solicitors of your move

9. Review and analyse your recovery process

Arrange a meeting for your entire Crisis Team to:

a) Study and analyse the Event Log

b) Identify strengths and weaknesses

c) Create a Business Continuity Plan to help you cope with any future threats to the business

10. Modify your Business Continuity Plan

Assign responsibilities for actions, updating and practices for after any potential incidents have occurred.

***BLOG POST FROM THE SMALL BUSINESS BLOG***

Small Business Success Story – Chad Mureta (App Empire)

November 9, 2016 by admin

Filed under Business News

Chad Mureta ran a real estate business when the impossible happened: A devastating car accident has caused to be delivered to the hospital, nearly taking out his arm. His business could not continue without him being physically present, but Mureta’s mounting medical bills meant he had to find an alternative source of income.

After reading a magazine article about mobile apps during his hospitalization, Mureta decided to try his hand at producing mobile applications. At the time, the industry was relatively new, but he felt the growth potential was worth the risk he would say.

“Lying in my hospital bed, I decided to take a Hail Mary shot and get into this industry.” Mureta said. “I needed a new business and decided to jump in with both feet.” Immediately, he started sketching out ideas for his own apps on pieces of paper. Soon after, he found a development company and outsourced all his work to create his first app.

Mureta took out a loan for $1800 to produce his first app. Fingerprint security – Pro. It soon became one of the 50 most popular apps in the App Store, earning him $140,000 in the process. From there, Mureta founded and sold three app companies – Empire Apps, Best Apps, and T3 Apps and now is currently running a blog called App Empire. He has produced 46 apps to date, and authored “App Empire: Make Money, have a Life and Let Technology Work for You”

Mureta advised other entrepreneurs to not be intimidated by their lack of experience in an industry if they see an opportunity. With a thirst for knowledge and the willingness to find and connect with the right people, anyone can begin to carve out an entrepreneurial path for him or herself, he said.

“I’m still not a tech guy,” Mureta said, “I couldn’t tell you how to program an app, but I can tell you how to make it a success. I researched the market and the consumers, and saw opportunities for people like myself. I kept researching and kept expanding my knowledge to grow my business and income.”

***ARTICLE BASED ON BUSINESSNEWDAILY.COM, WRITTEN BY NICOLE FALLON TAYLOR***

How to Know What Passions to Pursue in Business

November 7, 2016 by admin

Filed under Business News

We all have that question where we ask ourselves: “I have a passion for a lot of things. How do I know which one I should really choose?

Well, we all have heard many times in our lives, if you want to make a living, do something that you love to do. But our biggest concern is: how do we know if your passions can become a successful business? Fortunately, according to entrepreneur.com. there is a formula for determining if an idea is a viable opportunity.

It is a two-step process.

First: You look at the idea itself and see if it meets the criteria for success.

Second: You examine the industry to see if it is an attractive field for launching a new business.

If you launch a true opportunity in an attractive industry, your chances of turning a passion into a viable business go up dramatically.

THE FIRST STEP

Most of us have several things that we are passionate about. The trick is to pursue the one that has the strongest probability for success. Start by evaluating each of your passions against the criteria for a true business opportunity. Here are the critical components:

– Need – You have to obtain first hand evidence that people really need your product or service.

– Experience – You need to understand the industry from working in it or from regularly using the products.

– Resources – Cobble together the resources to create an initial prototype of your product or service.

– Customers – You have to find customers how are ready to buy your product as soon as you launch venture.

– Model – You need a sound business model where pricing, costs and margins allow you to make a profit.

Let’s take one example: Marshall Miller is a great example of turning a passion into a true business opportunity. He had a corporate job for eight years that he didn’t like. On weekends to maintain his sanity, he would take to the skies parachuting, paragliding, and base jumping. He and his friends started talking about how they might make a living doing this. They approached GoPro about filming their feats and making the footage available to the company – this was the birth of the GoPro Bomb Squad. Marshall now has a number of companies that sponsor his jumps. He displays their logos on his helmets and parachutes, and provides incredible footage they use in commercials and custom videos. Marshall has been doing this full-time for nearly 10 years and is one of the top human flyers in the world.

THE SECOND STEP

The second step for turning a passion into a business is to launch in an attractive industry. Research suggests that about 30 percent of success in business is a result of the industry you enter. Some are more attractive than others. Here are some tips:

– Size – You want an industry with at least 50 million in sales, but not more than a billion, that means there would be too much competition.

– Growth – You want an annual growth rate of 10 percent or more which means the industry is not shrinking.

– Margins – You want gross margins on products of 40 percent to 50 percent and profit margins of 10 to 20 percent which means it is possible to make money.

– Competitors – You want a handful of competitors but not hundreds which indicates that the market is overly saturated.

– Customers – You want multiple market niches for your product or service as opposed to a single group of buyers.

In sum, list the things you are passionate about and see which ones can become true business opportunities. Then evaluate each industry to see which ones have the highest probability for success. When you launch a true business opportunity in an attractive industry, you can create the company of your dreams.

***ARTICLE BASED ON ENTREPRENUER.COM***

7 Businesses That You Can Start With Less Than $100

November 4, 2016 by admin

Filed under Business News

There are always many obstacles to starting your own business, but money is not always one of them.

Many people have dreamed of owning a business, however, the biggest problem that many people face is that the amount of capital it takes to start it up and to also keeping it running in order for the business to keep going for as long as it can. Over the years, people have done many odd jobs to work. It does not matter if you’re a handyman or an Orange County CPA, you can make extra money on the side.

You may think that is crazy, but you will be surprised after reviewing the 7 business ideas that can actually be launched with less than $100.

Start a Tutoring Business

- There are a lot of students who need assistance in every subject – whether if it is in elementary school or college. If you have this knowledge, then starting your own tutoring business can become an appealing business idea that requires almost no capital. After all, the students already have the learning materials with them.

Start a Homemade Gourmet Foods

- Whether if it is soup mixes, jellies, or chocolates, people love gourmet food products. And, since you already have a kitchen, you just need cooking supplies, packaging, and basic marketing materials to get started.

Affiliate Marketing

- If you have a blog with a fair amount of followers, then you can become an affiliate. Basically, this just means that you plug other people’s products or services. As an affiliate, you get a special link. Whenever a visitor clicks on that link and makes a purchase, you’ll get a commission.

Tax Preparation

- Preparing taxes is another necessity. But, most of us don’t have the time or knowledge to take of this task. If you’re up to date on the latest tax regulations and enjoy crunching numbers, it can be a nice business during tax season.

Start a Personal Trainer Business

- Even though healthy is a priority for most of it, it can be a challenge to not only stay on track, but also make sure that exercising is done correctly so that you don’t injure yourself. You can become a personal trainer and motivate and monitor people when they exercise.

Start a business in Importing products

- You can purchase products from overseas in bulk and start selling them at markup. This is a very effective way to start. Increase your spending as you increase your revenues.

Airnb Host

- If you have an extra room or home, then rent it out on Airnb instead of just sitting there vacant. One example, was that one of the clients who use Airnb, was able to make $3,000 per month last year just renting out a room downstairs.

***ARTICLE BASED ON JOHN RAMPTON’S ENTREPRENEUR.COM***

You Can Save $20,000 on IRA Rollover Even You Miss The Deadline!

A new IRS rule could save you $20,000 or more if you miss the 60-day deadline for an IRA rollover. A 60-day rollover allows an individual to move money from one retirement account to another. Missing this 60-day deadline could lead to a massive tax bill. Originally, the appeals process for missing the 60-day deadline required a private letter ruling from the IRS, which charged a fee of $10,000. Add on professional fees to prepare the ruling and the total cost of appealing could be $20,000.

Under the new IRS rule, people will be able to complete a late 60-day rollover without penalties if they meet the three requirements below:

1. The late rollover must caused by one of the following 11 excuses:

- An error was committed by the financial institution making the contribution or receiving the contribution.

- The distribution was in the form of a check and the check was misplaced and never cashed.

- The distribution was deposited into and remained in an account that you mistakenly thought was a retirement plan or IRA.

- Your principal residence was severely damaged.

- One of your family members died.

- Your or one of your family members were seriously ill.

- You were incarcerated.

- Restrictions were imposed by a foreign country.

- A postal error occurred.

- The distribution was made on account of an IRS levy and the proceeds of the levy were returned to you.

- The party making the distribution delayed providing information that the receiving plan or IRA required to complete the rollover despite your reasonable efforts to obtain the information.

2. The late rollover must be completed as soon as practicable.

3. A written letter of certification for late rollover contribution must be sent to the receiving company.

Tips on How Small Businesses Can Become a Firm of the Future

November 2, 2016 by admin

Filed under Business News

How can a business become a firm of the future?

Well let’s take a step back, what does it mean to become a firm of the future?

Let’s look at this example, a firm of the future has been “in business for decades, achieving success using a tried-and-true formula of providing high quality work and or providing great service and product.”

Every year as we all witness the everlasting change of businesses, markets, and demands, we; as business owners sometimes worry about our methodology and business practices in our company.We begin to question if our practices are obsolete now, or are they still working for our business? Then the next question arises, how would we grow the practice while maintaining the winning factors that made the firm what it is? And because of this, many business owners worry too much about these changes and will then take up too much time and money.

Thus, begs the question: How can do we become firms of the future? Well worry no more! As an Orange County CPA, it is our sole duty to provide fresh tips on how you can become a survivalist in the battlefield of business. We have tips here that will help you achieve that!

Do not ever assume that and changes in the market and business world do not apply to you. As George Forsythe states, “even successful and happy firms may not be working as effectively as possible.” Always have a strategic review and assess your plan to measure out the pros and cons to your strategy. If they are working, try to find something that will cause the plan to fail, always assume that there will be change in the future.

Figure out where you stand. Create a transitional step tool that a firm can take in its culture, talent, and clients. Use informal brainstorming to identify steps that can help you move your firm forward.

Set your own priorities. When you start reviewing your firm’s status, be sure to look out for employees who show a lot of promise in their work. Prepare them for the next generation of leaders, this will ensure the security of your company when you are training new leaders.

Do not reinvent the “wheel.” Do not try to create a completely new plan to face the changes your company is facing. Take some of your strategies and create a new way to make them better. Focus on the aspects of creating a simpler, more effective method of that strategy and execute it. Reinventing a new strategy not only makes your employees and partner learn a new method, which takes time, but also, the strategy may not work in this changing marketing and business world.

**ARTICLE BASED ON AICPA.ORG***

How to Start a Business as a Couple, Aww! <3

October 31, 2016 by admin

Filed under Business News

We all know that the benefits of starting a business with a loved one seem obvious: You’re working with someone that you trust, and whom you already you enjoy spending time with. There are plenty of high profile success stories- Cisco, Slideshare, and Popsugar were all started by couples-to serve as inspiration for marrying business and love. But even the best partnerships can be strained by the stresses of running a business. Finding dedicated time for a relationship when there are shared work responsibilities to be delegated, staff to be managed, and conflicts to be resolved is no joke. And that’s why when things go wrong, perhaps nobody has it worse than partner who are both in love and in business. The stakes can be so much higher.

Let’s take an example, Heather and Allan Staker used to have date nights. Then the married couple launched a startup together. “Friday date night would turn into eating Indian food in front of our laptops” Heather says. “I was starting to feel overwhelmed – we were always together, but we were always working. I went to see a life coach, who told me, “you’ve got to stay in love with each other, apart from your business.” So they came up with a rule; No computers on date nights. It wasn’t easy, but they stuck to it. And with technology banished, their special dinners became a time to connect and talk as spouses rather than as cofounders.

So how can you start a business as a couple successfully?

– Start with A Plan

- For many couples, starting a business together feels natural: The idea most likely came out of the relationship. One example is that a couple can start to figure all of the work together and sort them out into tasks for each individual in the relationship. What do we mean by that? Have the husband work a series of tasks while the wife works on another series of tasks. Plan out these tasks together, and then assign them whoever does the tasks.

– Keep It Professional

- Once a couple both go full time together for their business, there would be constant closeness between the two. Although the privacy for the both of them to be intimate with each other is going to be less than before, it is still necessary to stay professional for the sake of the employees and the business. Keeping it professional instead of calling each other “babe” or other silly words would make the work environment more product, you never know, one of your employees may be feeling lonely with their love lives.

– Set Expectations Early

- Before pouring all your coupled energy into a budding business, it’s important to set parameters of where work ends and where life begins. For the Staker’s (Indian Food example), the no laptop rule was a romance life saver and it inspired additional at-home rules. For some others, the marriage becomes all about the work- and that can be ok too. An added benefit of married business partners is not being nagged on the weekend or on vacation to unplug, as spouses often do. A cofounder gets how impossible that is – and they’re right there next to you, clicking through emails. Make plans to do things together other than work to keep the relationships alive while keeping the business running well.

***ARTICLE BASED ON ENTREPRENEUR APRIL 2016***

IRS Scam Update: U.S charges 61 over India-based Impersonation Scam

October 28, 2016 by admin

Filed under Business News

In one of our earlier posts, we posted up a blog about how we can identify a fraudulent scam from a fake IRS representative.

Just recently, The US Justice Department charged 61 people and entities on Thursday on October 27, 2016 with taking part in a scam involving India-based call centers where agents impersonated Internal Revenue Service (IRS) where immigration and other federal officials and demanded payments for nonexistent debts.

The scam, which had operated since 2013, targeted at least 15,000 people who lost more than $300 million. Twenty people were arrested in the United States on Thursday while 32 individuals and five call centers in India have been charged, the department said in statement.

The defendants, including 24 people across nine U.S states, were indicted by a grand jury in the United States District Court for the Southern District of Texas.

United States Assistant Attorney General Leslie Caldwell said at a news conference that the United States will be seeking extradition of those based in India and warned others engaged in similar schemes.

“It’s really important for the scammers in India to know that the United States is looking at this, is watching them and they could, if they engage in that activity, be extradited to the United Sates and could sit in jail … for several years,” she said.

According to the indictment, the operators of the call centers in Ahmedabad, in the Indian state of Gujarat, “threatened potential victims with arrest, imprisonment, fines or deportation if they did not pay taxes or penalties to the government.”

Payments by victims were laundered by a U.S. network of co-conspirators using prepaid debit cards or wire transfers, often using stolen or fake identities, the statement said.

The call centers also ran scams in which victims were offered short-term loans or grants on condition of providing good-faith deposits or payment of a processing fee, it said.

The Investigation involved immigration and Customs Enforcement, Treasury, Homeland Security, U.S Secret Service and police officials, the Justice Department said.

***ARTICLE BASED ON REUTERS.COM***

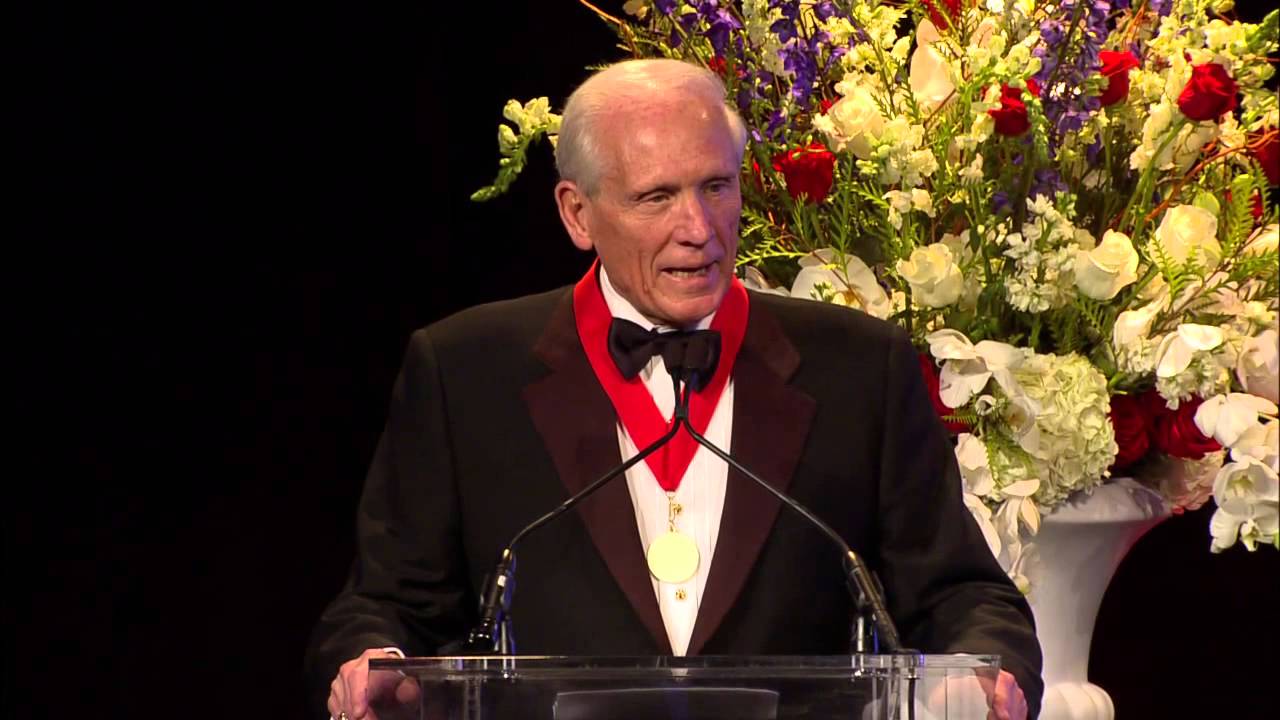

From World Ranked Swimmer to Successful Entrepreneur

October 26, 2016 by admin

Filed under Business News

We would like to share this story with you because this man shares similar values as we do as our company, and we want to show you how integrity takes each of us a long way in the business world.

Joseph M. Grant, a world class swimmer in his youth during the early 1960’s had an intensive work ethic. For those of you who do not know who he is, he was someone who became one of the most successful business men during his time of the century for someone who did not have a background business during his youth.

The main point of this blog is to inspire entrepreneurs that anyone from any background can become a successful business person. Although some of the articles written previously became successful in the creative aspect of the business, this man became a successful in the technical side of business. Technical business side is a very challenging feat, as it requires a lot of studying and education in order to become knowledgeable where you can turn that knowledge into business. This man was able to achieve that with hard work and dedication.

In the early 1970’s Grant credits the discipline that he used in his intense training as the foundation for his later successes. He also firmly believes that his unwavering ethical compass has allowed him to start a commercial banking empire with the most well-funded startup of any such bank in history. This same moral compass brought him to the brink of financial disaster in his personal life.

During the early 1980’s, Grant achieved his life’s goal when he appointed CEO and chairman of Texas American Bancshares, a prominent Texas banking company. He has spent his entire career preparing himself for this opportunity and had plans to take the bank to even higher levels of prosperity. When the outgoing chairman announced his successor, he also announced the first quarterly loss in the company’s 113-year history. Unfortunately for Grant, things did not get better. The bank’s assets were firmly concentrated in the oil industry in the southwestern U.S and world oil market fluctuations were wreaking havoc.

He faced anger form customers and investors. He also had to deal with the suicide of one of his senior officers. The stress and negative outlook were overwhelming in intensity. Grant had been a good corporate citizen and had invested heavily of his personal wealth in the bank. As the bank’s fortunes dwindled, so did his own. There were many opportunities to simple pack up his office, sell off his holdings, take his dished wealth and move on. He was encouraged to do so by members of his family and his friends. His essential decency would not allow him to do this. However, he saw himself as the captain of the ship and felt he was obligated to go down with it. He saw the bank seized by federal banking officials. Ultimately, the holding company entered bankruptcy and was sold. Only then, did he allow himself to move on. He lost everything.

Grant moved on. He became the CFO (chief financial officer) of Electronic Data Systems Corp. in 1990 and saw that company through a difficult spin off from General Motors Corp. later that same decade. He retired from Electronic Data Systems Corp and surprisingly, despite the trauma he had suffered with Texas American Bancshares, he moved back into the banking industry. He founded Texas Capital Bancshares and ended up with $80 million from his startup.

The purpose of this story is to understand that Grant firmly believes that his reputation for strict integrity and his willingness to lay everything on the line by refusing to bend the rules was the reason he was able to successfully raise the money for the new bank. To put it simply, people trusted him and trusted that he would always do the right thing.

Guess What?! You Can Lower Your Tax Bills with These 10 Tips!

October 24, 2016 by admin

Filed under Business News, Tax News

Since Tax Season is coming closer and closer, many of us are looking for ways to make their final moves in order to save money on their returns. Well don’t worry! Sonny CPA is here to save the day!

Here’s something you should know…

You can still take advantage of some easy ways to lower your tax bill.

Here are 10 ways to save as tax seasons approaches:

Earn Tax-free income – Some income or benefits may not be subject to income tax, and by earning more-tax free income, you can lower your tax liability. A few simple ways to do this is, invest in bonds, deposit money in a tuition plan for your child’s education, opening a health savings account or taking advantage of certain benefits by an employer such as health benefits, life insurance, disability insurance, dependent care assistance and educational assistance.

Flex your spending power– To save money on your tax bill, you might need to spend money elsewhere. Many employers offer a benefit that allows employees to lower their tax bill by using one they had planned on spending anyway, such as dependent care or medical expenses. These plans will let you divert part of your salary to an alternative account which you can then tap to pay medical bills. The advantage? You avoid income and Social Security tax on the money, saving you 20 to 35 percent or more. The maximum you can contribute to a health savings account is $2,500.

Pay child care bills with pre-tax dollars- If your employer offers benefits like a dependent assistance care plan, you may be able to use pre-tax dollars to pay for your child care. That can save you one-third or more of the cost, since you will avoid income tax on benefits up to $5,000.

Take advantage of home office deductions – If you use part of your home for business, you may be eligible for the new home office deduction. The simplified option allows you to take a deduction up to $1,500 based on $5 per square foot for up to 300 square feet of the area of your home used for work.

Keep track of your job-hunting expenses – If you were unemployed last year, make sure you have receipts for your job-hunting costs in front of you when you sit down to prepare your taxes. As long as you were looking for a new position in the same line of work, you may be able to deduct job-hunting costs, including travel expenses such as the cost of food, lodging and transportation. These expenses are itemized deductions and are deductible if they exceed 2 percent of your adjusted gross income.

Go green. – A tax credit is available for homeowners who have installed alternative energy equipment. Homeowners may claim 30 percent of what they spent on qualifying property, such as solar energy systems, geothermal heat pumps and wind turbines, including labor costs. There is no cap on this tax credit, which is available through 2016.

Boost your 401(k) retirement savings – Your contributions to a qualified 401(k) may lower your tax bill and help you build financial security. You can contribute to up to $17,500 to your 401(k) (or $23,000 if you are age 50 or older by the end of the year). Money contributed to the plan is not included in your taxable income.

Maximize your individual retirement account contributions – IRA contributions may reduce your taxable income, and you have until the date you file your taxes to contribute to a traditional IRA for the previous tax year. If you contribute to an IRA or 401(k) you may also be able to claim the retirement saver’s credit of up to $1,000 for singles and $2,000 for couples, which lowers your tax liability and results in a larger refund check.

Make charitable donations – To earn tax deductions and help those in need, consider donating goods that you no longer use. From clothes and old toys, to electronics, books and furniture, there are a multitude of donations you can deduct. Mobile apps like ItsDeductible can help you keep a list of what you donate throughout the year and provide an estimated value of donated goods such as clothing, furniture or supplies. Remember that any donation worth more than $250 will require a receipt, and there are limits if you donate more than 20 percent of your adjusted gross income.

Think about next year – With some advance planning, you can get a head start on next year’s taxes, and take the opportunity to do some things mentioned above you may have missed which can help put you in better shape next tax season.

**BASED ON ARTICLE “10 WAYS TO LOWER YOUR TAX BILL” BY LISA GREEN-LEWIS FROM USNEWS.COM**

Take A Break From Your Work! Free Time Is Important!

October 21, 2016 by admin

Filed under Uncategorized

There was an interesting article written by Bill Sheridan from MACPA.org who talked about how business people or anyone who works should take a break.

Wanna know what he did recently?

He did absolutely “nothing.” During the time when he did “nothing” he learned how to jet ski, played golf, and read two books. Additionally, he went out, ate a bunch of food, and drank too much, along the way, he had late night gatherings with friends, and family, had a hangover, and slept in. He even downloaded Pokemon Go and went around spending a lot of time with his family.

The part about we said he did “nothing” was the work part. He did not do any work during that week.

According to Harvard Business Review reporters Shawn Achor and Michelle Gielan said that “Americans used to take almost three weeks of vacation a year (20.3 days) in 2000, but they took only 16.2 days of vacation in 2015. Over the past 15 years, Americans have lost nearly a week of vacation.”

Additionally, according to a new study by the U.S Travel Association and Project: Time, said “for the first time in recorded history, more than half Americans (55 percent) left vacation days unused, which equates to around 658 million unused vacation days.”

The Harvard Business Review article also said:

Remember, this is paid time off that is not being used. Let us ask you two questions to make this idea come alive: Would you do your job for free? And do you take all your vacation days? If you say no to the first, you had better say yes to the second.

In truth, if you are not taking all your time off, you’re not working more- you’re volunteering your time. This is our favorite conclusion from the study” “By giving up this time off, Americans are effectively volunteering hundreds of millions of days of free work for their employers, which results in $61.4 billion in forfeited benefits.”

One thing to note too, just because you are working longer hours and ignoring your vacation makes you more productive and more promotable. It’s a myth. In fact, the opposite is true. Taking your vacation time actually increases the likelihood that your will get a raise or a promotion.

So take a break folks. Your employers are paying you to take some time off. If you have your own business and worry about taxes? Your local Orange County CPA will help you out! Take advantage of their services. Why aren’t you taking it? Get out of town. Relax. Forget about work and do something fun for a change.

Many studies have shown that you will come back refreshed, more productive, and considerable more promotable than if you had stayed in the office.

The free time does not belong to your employer, it belongs to you.

***ARTICLE BASED ON BILL SHERIDAN OF MACPA.ORG***

Only 10 Companies Control Almost Everything We Eat!

October 20, 2016 by admin

Filed under Uncategorized

Did you know that most of the products in the groceries we buy are actually sold by just 10 companies?

Most people would think that the products we buy from grocery stores are from various different companies. In reality, these 10 companies, which are parent companies by the way, own these sub businesses where it enables them to sell products that are seemingly from different companies. Well my friend, here are the 10 companies that control almost everything we eat:

Kraft Foods – Founded in 1903 by James Kraft, and it is now the second largest producer of packaged goods in the world. Their goods are sold in 155 countries.

Nestle SA – Nestle is the world’s largest producer of food products, boasting a record level of annual turnover.

Procter & Gamble– The global market leader in consumer products, Procter & Gamble is also the largest advertising company on the planet, spending around $8 billion on advertising a year. Its best-known brands include Fairy, Ariel and Lenor, as well as Pampers, Tampax, Head & Shoulders, Pantene, Old Spice, Hugo Boss, dolce & Gabbana, Gucci…and many more.

Johnson & Johnson – Cosmetics, hygiene products and medical equipment are among the things that Johnson & Johnson produces through its 230+ subsidiary companies. They also make a wide range of pharmaceuticals and body care products, including Acuvue and Penaten.

Unilever – One of the leading producers of household cleaning products. Unilever also makes plenty of the food you consume, as well as the perfume you wear.

Mars, Inc. – The chances are that each and every one of us consumes products owned by Mars on a daily basis. They make some of the most popular sweets, including M&M’s, Snickers, Mars, Milky Way, Skittles, Twix, Bounty, Celebrations, and Starburst, as well as the food we give to our pets in the form of Pedigree, Whiskas, and Kitekat. Among their savoury products are Uncle Ben’s and Dolmio.

Kellogg’s – Founded as the Battle Creek Toasted Corn Flake Company in 1906, in Michigan, USA, Kellogg’s is now one of the largest producers of breakfast cereals and convenience food products in the world.

General Mills, inc – One of the world’s largest corporations, General Mills, Inc. focuses on the production of food products, toys and clothes, and also owns an extensive network of restaurants. Some of their best known products include the Green Giant brands of canned vegetables, premium-brand ice cream Häagen-Daz, and Nature Valley cereal bars.

Pepsi Co – PepsiCo was formed in 1965, when The Pepsi Cola Company merged with Frito Lay. Its products include the drinks 7up, Mountain Dew and Tropicana as well as Walkers Crisps, and Cheetos.

Coca – cola– The largest producer of nonalcoholic beverages, concentrates and syrups in the world, Coca-Cola is also one of the biggest companies in the USA. Its products, which include not only the eponymous soft drink but also Fanta, Sprite, Schweppes, and Bon Aqua, are sold in more than 200 countries.

***BASED ON BRIGHTSIDE.ME***

Hurricane Matthew Victims Suffered Enough. IRS Gives Some Help with Tax Relief

October 18, 2016 by admin

Filed under Business News

Hurricane Matthew has devastated families and businesses in North Carolina as well as South Carolina, Georgia, and Florida. For those affected, life becomes more difficult as their homes, businesses, and possessions were damaged or lost. Unfortunately, life still goes as many tax deadlines arrive which adds more to worry about for extension tax filers.

Therefore, in light of these events, the IRS has decided to give tax relief to those affected by the hurricane. Instead of worrying about trying to file taxes in 2016, extension tax filers will now have until March 17th 2017 to file their taxes. These tax payers that suffered an uninsured or unreimbursed disaster losses will be allowed to claim for the year of 2016 or for their 2015 extension.

The IRS will also waive late-deposit fees for payroll and excise taxes that are usually due at the beginning of October if they are paid by October 19th.

This relief applies to those that live within the recorded disaster area. No action is necessary from the affected tax payer if they live in the disaster area, but if they are affected and out of the area, they must contact the IRS to receive the relief.

For help with information and eligibility call the IRS at 866-562-5227 or visit disasterassistance.gov

Don’t Fall for These Scams! IRS – List of Tax Scams for The 2016 Filing Season

October 18, 2016 by admin

Filed under Uncategorized

Many people all over the world have fallen into the trap of a scam or a fraud from a criminal. Every day, our society becomes more intelligent while technology in our world advances. But, we aren’t the only ones who are getting smarter; criminals are getting smarter at scamming people every day as well.

Let us give you a story that we heard from one of our clients. Let’s pretend that our client’s name is Jenny. Jenny makes a lot of money with her business, but she also spends a lot of money as well. Unfortunately, her spending problems seem to be endless, and since she does not have anyone to monitor her spending, she does not know or realize how much she is accumulating. One day during tax season, she received a phone call from an IRS representative stating that she needed to file her taxes soon, and also stated that she owed $30,000. With fear, she became very frightened and astounded by the hefty amount she had to pay. Luckily, she knew she had money in her bank account who could save her. After saying that she was able to pay her debt, the representative proceeded on to say that she must withdraw that money from her bank and hand it to one of the representatives who will pick it up from her. She did as she was told, however, during the second that she was withdrawing $30,000 in cash from her bank account, she suddenly realized that, there was no way an IRS representative would just pick up money from a bank, nor receive phone calls from a representative. She calls the police, and told them what happened. The police said that they would come, but also told her to give the money to the representative anyway. With confusion, she did as she was told. When the representative arrived, she gave the money to him, but suddenly… A whole flock of police came out and arrested the representative. It was a scam after all.

This is one type of scam that has been outdated, but let’s look at the more recent ways scammers take taxpayer money.

IRS States: “Taxpayers across the nation face a deluge of these aggressive phone scams. Don’t be fooled by callers pretending to be from the IRS in an attempt to steal your money,” said IRS Commissioner John Koskinen. “We continue to say if you are surprised to be hearing from us, then you’re not hearing from us.”

This January, the Treasury Inspector General for Tax Administration (TIGTA) announced they have received reports of roughly 896,000 contacts since October 2013 and have become aware of over 5,000 victims who have collectively paid over $26.5 million as a result of the scam.

Scammers make unsolicited calls claiming to be IRS officials. They demand that the victim pay a bogus tax bill. They con the victim into sending cash, usually through a prepaid debit card or wire transfer. They may also leave “urgent” callback requests through phone “robo-calls,” or via a phishing email.

Many phone scams use threats to intimidate and bully a victim into paying. They may even threaten to arrest, deport or revoke the license of their victim if they don’t get the money.

Scammers often alter caller ID numbers to make it look like the IRS or another agency is calling. The callers use IRS titles and fake badge numbers to appear legitimate. They may use the victim’s name, address and other personal information to make the call sound official.

Here are five things the scammers often do but the IRS will not do. Any one of these five things is a tell-tale sign of a scam.

The IRS will never:

- Call to demand immediate payment, nor will the agency call about taxes owed without first having mailed you a bill.

- Demand that you pay taxes without giving you the opportunity to question or appeal the amount they say you owe.

- Require you to use a specific payment method for your taxes, such as a prepaid debit card.

- Ask for credit or debit card numbers over the phone.

- Threaten to bring in local police or other law-enforcement groups to have you arrested for not paying.

If you get a phone call from someone claiming to be from the IRS and asking for money, here’s what you should do:

If you don’t owe taxes, or have no reason to think that you do:

- Do not give out any information. Hang up immediately.

- Contact TIGTA to report the call. Use their “IRS Impersonation Scam Reporting” web page. You can also call 800-366-4484.

- Report it to the Federal Trade Commission. Use the “FTC Complaint Assistant” on FTC.gov. Please add “IRS Telephone Scam” in the notes.

If you know you owe, or think you may owe tax:

- Call the IRS at 800-829-1040. IRS workers can help you.

Stay alert to scams that use the IRS as a lure. Tax scams can happen any time of year, not just at tax time. For more, visit “Tax Scams and Consumer Alerts” on IRS.gov.

Each and every taxpayer has a set of fundamental rights they should be aware of when dealing with the IRS. These are your Taxpayer Bill of Rights. Explore your rights and our obligations to protect them on IRS.gov.

***BASED ON IRS.GOV***

Solar Panels Do More than Just Save Money?!

October 14, 2016 by admin

Filed under Uncategorized

What is the first thing that comes to mind when someone asks why you would buy solar panels? Most likely, save money. We asked some of our co-workers what the first thing that came to mind when they heard that phrase, and they said the same thing.

Whether your motivations for going solar are economic, environmental, or personal, going solar actually has a benefit for everyone. Here are the top 10 reasons why solar energy is very beneficial.

1) You can drastically reduce or even eliminate your electric bills.

- If you are a homeowner, business, or nonprofit, electricity costs essentially cuts a large portion of your monthly expenses. With a solar panel system, you will generate free power for your system’s entire 25+ year lifecylcle. Even if you do not produce 100 percent of the energy you consume, solar will reduce your utility bills and you’ll still save a lot of money.

2) Earn a great return on your investment.

- Solar panels are not a waste of money; in fact they are one of the best ways to invest with returns that far outweigh traditional investments like stocks and bonds. Because of the substantial savings that a homeowner or business owner incurs, they are able to pay off their solar panel system within seven to eight years.

3) Protection from rising energy costs.

- For the past 10 years, residential electricity prices have gone up by an average of three percent annually. By investing in a solar energy system now, you can fix your electricity rate and protect against unpredictable increases in electricity costs. If you’re a business or homeowner with fluctuating cash flow, going solar also helps you better forecast and manage your expenses.

4) Increase your property value.

- Multiple studies have found that homes equipped with solar energy systems have higher property values and sell more quickly than non-solar homes. Appraisers are increasingly considering solar installations as they value homes at the time of a sale, and as homebuyers become more educated about solar, demand for properties equipped with solar panels will continue to grow.