Happy Holidays! Year-End Tax Saving Tips to Spend or Save for the Holidays

It looks like the end of the year is coming, and we are pretty sure many of you are still frantically shopping for gifts for your family and friends. Do you ever wish you had more money to spend for your friends and family, but just could not figure out how you can save more money?

Well have no fear! We are an Orange County CPA firm who will be here to provide tips on how you can cut tax spending to save or have more money to spend for you your loved ones.

Capital Gains and Dividends. The tax rate on qualified capital gains (net-long term gains) and dividends range from 0 – 20%, depending on the individuals income tax bracket.

STRATEGY: Spikes in income, whether capital gain or other income, may push gains into either the 39.6 percent bracket for short-term gain or the 20% capital gains bracket. Spending the recognition of certain income between 2016 and 2017 may help minimize the total tax paid for the 2016 and 2017 tax years.

State and local sales tax deduction. The PATH Act made permanent the itemized deduction for state and local general sales taxes. That deduction may be taken in lieu of state and local income taxes when itemizing deductions.

STRATEGY: Generally IRS tables based upon federal income levels and a taxpayer’s number of departments are used for this optimal deduction. Taxpayers who wish to claim more than the table amounts must provide adequate substantiation.

Tuition and fees deduction. The PATH Act extended the above-the-line deduction for qualified tuition and related expenses for two years, for expenses paid before January 1, 2017. The maximum amount of the tuition and fees deduction is $4,000 for an individual whose AGI (Adjusted Gross Income) for the tax year does not exceed $65,000 ($130,000 in the case of a joint return), or $2000 for other individuals who’s AGI does not exceed $80,000 ($160,000 in the case of a joint return)

STRATEGY: Payments by year-end 2016 may be particularly critical to taking this deduction. There is some – but not unlimited – flexibility regarding the deductibility of tuition paid before a semester begins. As with the AOTC, the deduction is allowed for expenses paid during a tax year, in connection with an academic term beginning during the year or the first three months of the next year.

Nonbusiness energy property credit. The PATH Act extended the nonrefundable non business energy property credit allowed to individuals, making it available or qualified energy improvements and property placed in service before January 1, 2017.

STRATEGY: Several overall limitations apply. A credit amount for qualified energy efficiency improvements equals 10 percent of the amount paid or incurred during the tax year and 100% of the amount paid or incurred for qualified energy property during the tax year. The maximum credit amount for qualified energy property varies depending on the type of property, further all nonbusiness energy property carries a $500 maximum lifetime credit cap.

Individual Shared Responsibility Payments. For 2016, the individual shared responsibility payment is the greater of 2.5% of house-hold income that is above the tax return filing threshold for the individual’s filing status or the individual’s flat dollar amount, which is $695 per adult and 347.50 per child, limited to a family maximum of $2,085, but capped at the cost of the national average premium for a bronze level health plan available through the Marketplace in 2016.

STRATEGY: Open enrollment for coverage through the Health Insurance Marketplace for 2016 has closed. However, some qualifying life events may make an individual eligible for non-filing season special enrollment.

Medical expense deduction. Taxpayers who itemized deductions (for regular tax purposes) may claim a deduction for qualified reimbursed medical expenses to the extent those expenses exceed 10% of adjusted gross income (AGI), unless the tax payer falls within an age-based exception. Taxpayers (or their spouses) who are aged 65 or older before the close of the tax year, may apply the old 7.5% threshold for tax years but only through 2016.

STRATEGY: Tax payers who are age 65 or older may consider accelerating medical costs into 2016 if they want to itemize deductions since the AGI floor for deductible expense rise from 7.5% to 10% in 2017. For deductions by cash-basis taxpayers in general, including for purposes of the medical expense deduction, a deduction is permitted only in the year in which payment for services rendered is actually made.

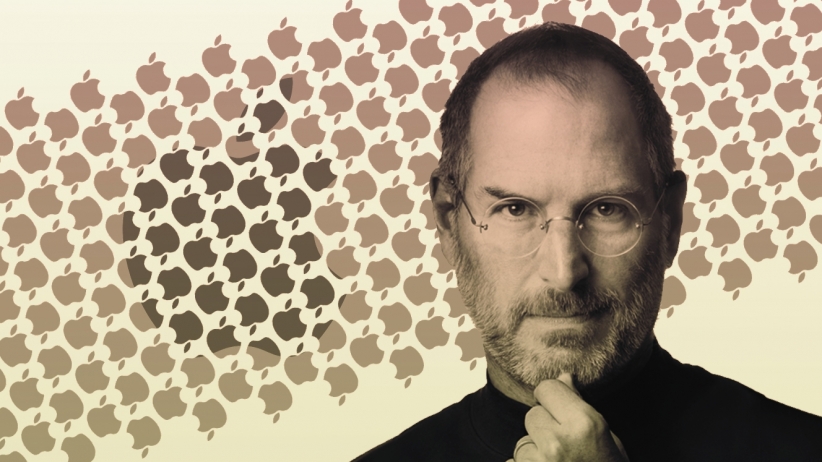

A Smart Business Decision Maker = A Successful Entrepreneur

December 19, 2016 by admin

Filed under Entrepreneurship

Many successful business leaders all share a common skill that most people do not posses. Although this skill comes in all forms and is dependent on the amount of opportunities given to them, they all still have to undergo a process whether it takes a long time to process or a very short amount of time. That skill, my fellow entrepreneurs is: Smart Business Decision-making. Every day people from all over the world make decisions. You may not realize it but you, the reader, just made the decision to read this article (Thanks by the way!). However, let’s take it to a business perspective; business leaders, (including yourself) “make dozen of decisions a day” that creates an impact to the success of their company while creating an influence factor to employees as well. “Developing such a skill requires a combination of education, experience, and intuition.”

Marci Martin, author of Business News Daily who wrote the article “How to Make Effective Business Decisions” has stated a great quote: “There are many things that influence how an individual makes decisions. They include emotions, perceived personal and professional risks and rewards, preparation through experience or education, deadlines, stress and a host of others. It is important to mitigate the irrational and embrace the rational.”

Many decisions always comes with a process, as mentioned above, there are many factors that come into play before coming up with a conclusion. Some of those decisions usually come from a “gut feeling” while others come from undergoing a long process of asking others, and a more common form would be the opportunity cost (Is it more beneficial to me than the cost?). As Martin mentioned, the “bottom line is that being an effective decision-maker requires practice.”

Gayle Abott, President of Strategic Alignment Partners, a human consulting firm, has implemented a four- point strategy to deploy whenever you must act:

– Identify the problem.

– Analyze the possible solutions

– Evaluate the possibilities that are likely to bring you closer to your goal.

– Make the decision.

However, as easy as this 4 point system sounds, this type of strategy does not come easily for any beginner. As Abott has said in Business News Daily, it takes years of practice to master this skill. Many people who have become masters did not simply start off as talented decision makers, they made many mistakes in the past, learned from them, and simply moved on. The most crucial part in any decision making in a business, is the ability to learn from them. It is not easy as you think it is because people still make the same mistake, whether it’d be motivated by an emotion, by influence, or by stubbornness. The reality is that, it will not be easy to become a smart business decision maker until you have made enough decisions to consider yourself a smart business decision maker.

How to Deal with Stress of Running a Business

December 7, 2016 by admin

Filed under Entrepreneurship

Are you a business owner who has been through a lot of stress these past couple months? Especially, when tax season is coming and you have no one to prepare your tax forms for you? Well, let us take a moment to tell you that, if you are reading this blog post right now, you are probably looking for someone to prepare your tax returns or looking for a CPA accountant who can do that work for you. In fact, we are a CPA firm in case you haven’t noticed!

Anyway, this blog post is not about how to hire an Orange County CPA, the main point of this blog is to talk about how to deal with stress when running a business. So how can you deal with it? According to Pratik Dholakiya, Co-Founder of E2M, he wrote an article called 3 Tactics for Dealing With the Stress of Running a Business, which talks about dealing with stress and said that an entrepreneur is always required to be involved in every activity that their business is undergoing, always taking on new challenges, and creating bonds and relationships while learning on the go. Of course, as Pratik mentioned, will be overwhelming, which is something that most entrepreneurs face.

Pratik listed out three powerful ways to fight against this overwhelming stress that will keep you on track with your business goals without going insane.

1) Create a priority list, and list all of your goals in a list from most important to least important.

Sounds easy right? It is! If you actually take the time to do it. The overwhelming amount of work you have to do is actually not that bad if you know how to prioritize and focus through them on the entire day. Keep a list of priorities and keep a list of dates to make sure when to start on those, and when the deadline is for each of them. This is very important, as this will keep your mind organized, and you can keep a simple focused mindset without going off in a tangent. Complete the task that is most important, and then once that is complete, move on to the next one and complete that one, and keep going through them all until you have completed them all. If you have a reoccurring event that constantly needs to be taken care of, always keep that task in your list.

2) Relax and clear your mind before you go to bed, go back into work mode the next morning.

Of course, every night, we all feel like we have so much information in our heads that we just want to explode. The endless thinking is killing us all, and we just want to keep thinking. Do not try to fight through this complicated matter, instead, clear your mind, and then set yourself up to think about first thing tomorrow morning. You will feel refreshed the first thing in the morning, and your decision making will be better than yesterday’s.

3) Analyze and reassess your circle of control

Pratik explains how we should focus our energies on things that are directly in our control and how we should not be drawn to things where we have little to no influence over. He makes a good point about how most entrepreneurs start with a great idea of what their circle of control has, but as time progresses and they meet new business people, the circle will consistently change. Depending on the entrepreneur, the circle will either shrink or it will grow. The point is, it will not stay the same, it is always changing, so it would be wise to consistently, evaluate your circle of control. “When you are feeling hammered, and are struggling to keep yourself sane in the middle of your fast-growing business, it’s a good idea to take a step back and ask yourself, how much of that which you are contending with do you actually control?” (Dholakiya)

This Skill is What Determines the Success of Your Business

December 5, 2016 by admin

Filed under Entrepreneurship

Just recently, there was an article written by Matt Fore who talked about an important skill that would subsequently determine the success of your business. In his article, he provided an example from his experience about one of his business friends and talked about this important skill that he was lacking, and how it failed to bring him to the path of financial success.

The story unfolds to talk about a man named Earl who was a business man and a magician who performed amazingly for audiences such as adults and families. In fact, his talent was so good, that he was comparable to Houdin Thurstonfield, however, given his talents, he could not generate enough viewers to come to his magic show. Although his talents were astonishing and jaw-dropping, he lacked this important skill needed to get a business of his magic show going.

Do you know what skill he is lacking?

If you guessed Communications, you are certainly correct!

The most important skill that determines the life of a business is communication. Many Orange County CPA Firms and Entrepreneurs including Matt Fore will tell you that “An effective marketing campaign should stir a response; it should stir a conversation. It should give a compelling reason for the client to reach out and receive a benefit.” (Fore)

Communication is very important in business because it plays a fundamental role in all the factors of business. The internal part of your business, which is yourself and the partner/employees are crucial because communicating effectively within your business organization will efficiently complete short term goals and possibly long term goals. Additionally, you want to make sure that your external communication is also well trained, for example your consumers. How are they receiving the messages that you send out to them? Compare what you see and what they see in your advertisements, are you both in the same page?

Another thing to note too is that communication builds and maintains relationships, communication is very important because you want all your business partners to understand your situation, your goals, and any other factor that your partners may want to know. A CPA firm typically asks for effective communication. In fact, it is practically required that you have effective communication skills, otherwise, your CPA will not be able to get the job done correctly if you don’t!

So there you have it, communication. Remember to always have a good mindset and make sure to always answer any questions if needed from your fellow business partners or consumers.

***ARTICLE BASED OFF OF MATT FORE OF ENTREPRENEUR.COM***

How Hard is it to Invest in Real Estate?

December 1, 2016 by admin

Filed under Entrepreneurship

There was an interesting article written by Scott Trench who recently wrote an article about how easy it is to invest in Real Estate. In the beginning he talks about how some of the most successful entrepreneurs started off with nothing. That’s a very typical story of how entrepreneur’s become millionaires. Many of us has read many stories about these successful people, but what about working class or middle class people?

In this article, he personally talks about how he was able to achieve his financial freedom through gradual investment of real estate while working his full time job that he personally loves, while making medium to medium high income. It is true that most people would love to live that kind of lifestyle of being able to make additional money on the side while making money from their jobs that they love. That is the dream! However, later in the article he talks in detail about how every single investment always has a risk, which is true! Any investment always comes with risk, no matter how big or small. Additionally, there is some commitment involved, which is one of the reasons most people could not leave their jobs to pursue an investment journey to reach financial freedom.

At the end of the article, Trench states that real estate investing does not have to be so hard. Although there are some instances where it is easy if you make it to be. There are a few considerations to think about before you get into investing property.

The Good, Bad, and Ugly of Real Estate Investments states that knowing your market well would be beneficial. Looking for deals that are underpriced for one reason or another would be a good idea, because you won’t know which deals are underpriced unless you have a good sense of how properties are priced.

And another problem that you may have to consider is who the tenants are. There are some stories where tenants would bring in stolen merchandise into the property and store them in there. Another instance would be, party goers, they may wreck your property which will incur many costs and repairs, which will cost more than what you are earning from them for rental payment. And another is when tenants treat your property like its theirs, painting the homes, adding unnecessary items to the home that stays in the home etc. Lesson here is to make sure to check your tenants on a frequent basis.

Overall, investing can be easy, but always remember to consider some of these facts as they can be very helpful in your future obstacles that you may face when you invest in real estate.

**Article Based on Biggerpockets.com**

8 Things Entrepreneurs Do Differently

November 16, 2016 by admin

Filed under Business News

Entrepreneurship goes beyond Elon Musk and Mark Zuckerberg. It is mostly an approach to life that favors creativity over conformity and action over inaction. Author and investor, James Altucher says that “Being an entrepreneur doesn’t mean starting the next Facebook.” Or even starting any business at all. It means finding the challenges you have in your life, and determining creative ways to overcome those challenges. It means finding the challenges you have in your life, and determining creative ways to overcome those challenges.”

So even if you’re not tinkering away at the next world-changing invention or looking to set up shop in Silicon Valley, there are aspect to the entrepreneurial mindset that will enrich your work and life. Here are 8 things entrepreneurial people do differently.

– They’re brave enough to commit to their dreams.

- Entrepreneurs choose to forego the security and familiarity of a ‘regular job’ to live an uncertain and insecure lifestyle. It takes a lot of bravery to make that tradeoff, but for icons like Walt Disney, the potential reward is worth it.

– They think of their customers more than themselves.

- Entrepreneurs are rarely out to seek fame for themselves. Instead, they’re more concerned with the people they want to help or the problem they want to solve. This infuses their task with a layer of meaning that can be the difference between success and failure when things get tough. A quote said by Guy Kawasaki: “In your darkest, most frustrated hours, remember the value you are trying to add to peoples’ lives, the satisfaction you’ll feel, or the cause that you’ll further.”

– They never stop learning.

- Since they’re in the business of creating new products and inventing new ways of doing things, much of what entrepreneurs do can’t be taught in a classroom. They know that the most important lessons are learned through living, so throughout their lives, they remain open, flexible, and curious in order to absorb as much as possible.

– They never give up.

- Rarely does an inventor or entrepreneur success on the first try. To create something lasting and worthwhile, it usually takes years of hard work, focus, and dedication. An idea is just a starting point. Persistence is a critical element of entrepreneurship.

– They love failing.

- For most people, the fear of failure is entirely paralyzing, but for entrepreneurs, failure is something to embrace. It’s an indication of pushing the limits, and inevitable when one is constantly trying new things.

– They find and fill a need of the world.

- Entrepreneurs want to do more than indulge their own interests – they want to solve a problem or create a product that satisfies a need. Some started businesses because of frustration with an inefficient or defective system. Others were moved by a personal encounter with poverty or misfortune.

– They take old ideas and make them way, way better.

- While one might think that entrepreneurs are focused mainly on never-seen-before ideas, they often revamp an existing model or upgrade an outdated product. Sometimes, these reinvented ideas change the way we exercise, read, or eat.

– Above all, they act.

- Entrepreneurs execute when for many others, an idea simply fades into the past. They are masters of turning abstract into the concrete. This seemingly simple action is one of the great challenges of life and in the end, it’s what defines an entrepreneur.

***ARTICLE WRITTEN BY JOE VAN BRUSSEL OF HUFFINGTONPOST.COM***

Small Business Success Story – Chad Mureta (App Empire)

November 9, 2016 by admin

Filed under Business News

Chad Mureta ran a real estate business when the impossible happened: A devastating car accident has caused to be delivered to the hospital, nearly taking out his arm. His business could not continue without him being physically present, but Mureta’s mounting medical bills meant he had to find an alternative source of income.

After reading a magazine article about mobile apps during his hospitalization, Mureta decided to try his hand at producing mobile applications. At the time, the industry was relatively new, but he felt the growth potential was worth the risk he would say.

“Lying in my hospital bed, I decided to take a Hail Mary shot and get into this industry.” Mureta said. “I needed a new business and decided to jump in with both feet.” Immediately, he started sketching out ideas for his own apps on pieces of paper. Soon after, he found a development company and outsourced all his work to create his first app.

Mureta took out a loan for $1800 to produce his first app. Fingerprint security – Pro. It soon became one of the 50 most popular apps in the App Store, earning him $140,000 in the process. From there, Mureta founded and sold three app companies – Empire Apps, Best Apps, and T3 Apps and now is currently running a blog called App Empire. He has produced 46 apps to date, and authored “App Empire: Make Money, have a Life and Let Technology Work for You”

Mureta advised other entrepreneurs to not be intimidated by their lack of experience in an industry if they see an opportunity. With a thirst for knowledge and the willingness to find and connect with the right people, anyone can begin to carve out an entrepreneurial path for him or herself, he said.

“I’m still not a tech guy,” Mureta said, “I couldn’t tell you how to program an app, but I can tell you how to make it a success. I researched the market and the consumers, and saw opportunities for people like myself. I kept researching and kept expanding my knowledge to grow my business and income.”

***ARTICLE BASED ON BUSINESSNEWDAILY.COM, WRITTEN BY NICOLE FALLON TAYLOR***

How to Know What Passions to Pursue in Business

November 7, 2016 by admin

Filed under Business News

We all have that question where we ask ourselves: “I have a passion for a lot of things. How do I know which one I should really choose?

Well, we all have heard many times in our lives, if you want to make a living, do something that you love to do. But our biggest concern is: how do we know if your passions can become a successful business? Fortunately, according to entrepreneur.com. there is a formula for determining if an idea is a viable opportunity.

It is a two-step process.

First: You look at the idea itself and see if it meets the criteria for success.

Second: You examine the industry to see if it is an attractive field for launching a new business.

If you launch a true opportunity in an attractive industry, your chances of turning a passion into a viable business go up dramatically.

THE FIRST STEP

Most of us have several things that we are passionate about. The trick is to pursue the one that has the strongest probability for success. Start by evaluating each of your passions against the criteria for a true business opportunity. Here are the critical components:

– Need – You have to obtain first hand evidence that people really need your product or service.

– Experience – You need to understand the industry from working in it or from regularly using the products.

– Resources – Cobble together the resources to create an initial prototype of your product or service.

– Customers – You have to find customers how are ready to buy your product as soon as you launch venture.

– Model – You need a sound business model where pricing, costs and margins allow you to make a profit.

Let’s take one example: Marshall Miller is a great example of turning a passion into a true business opportunity. He had a corporate job for eight years that he didn’t like. On weekends to maintain his sanity, he would take to the skies parachuting, paragliding, and base jumping. He and his friends started talking about how they might make a living doing this. They approached GoPro about filming their feats and making the footage available to the company – this was the birth of the GoPro Bomb Squad. Marshall now has a number of companies that sponsor his jumps. He displays their logos on his helmets and parachutes, and provides incredible footage they use in commercials and custom videos. Marshall has been doing this full-time for nearly 10 years and is one of the top human flyers in the world.

THE SECOND STEP

The second step for turning a passion into a business is to launch in an attractive industry. Research suggests that about 30 percent of success in business is a result of the industry you enter. Some are more attractive than others. Here are some tips:

– Size – You want an industry with at least 50 million in sales, but not more than a billion, that means there would be too much competition.

– Growth – You want an annual growth rate of 10 percent or more which means the industry is not shrinking.

– Margins – You want gross margins on products of 40 percent to 50 percent and profit margins of 10 to 20 percent which means it is possible to make money.

– Competitors – You want a handful of competitors but not hundreds which indicates that the market is overly saturated.

– Customers – You want multiple market niches for your product or service as opposed to a single group of buyers.

In sum, list the things you are passionate about and see which ones can become true business opportunities. Then evaluate each industry to see which ones have the highest probability for success. When you launch a true business opportunity in an attractive industry, you can create the company of your dreams.

***ARTICLE BASED ON ENTREPRENUER.COM***

7 Businesses That You Can Start With Less Than $100

November 4, 2016 by admin

Filed under Business News

There are always many obstacles to starting your own business, but money is not always one of them.

Many people have dreamed of owning a business, however, the biggest problem that many people face is that the amount of capital it takes to start it up and to also keeping it running in order for the business to keep going for as long as it can. Over the years, people have done many odd jobs to work. It does not matter if you’re a handyman or an Orange County CPA, you can make extra money on the side.

You may think that is crazy, but you will be surprised after reviewing the 7 business ideas that can actually be launched with less than $100.

Start a Tutoring Business

- There are a lot of students who need assistance in every subject – whether if it is in elementary school or college. If you have this knowledge, then starting your own tutoring business can become an appealing business idea that requires almost no capital. After all, the students already have the learning materials with them.

Start a Homemade Gourmet Foods

- Whether if it is soup mixes, jellies, or chocolates, people love gourmet food products. And, since you already have a kitchen, you just need cooking supplies, packaging, and basic marketing materials to get started.

Affiliate Marketing

- If you have a blog with a fair amount of followers, then you can become an affiliate. Basically, this just means that you plug other people’s products or services. As an affiliate, you get a special link. Whenever a visitor clicks on that link and makes a purchase, you’ll get a commission.

Tax Preparation

- Preparing taxes is another necessity. But, most of us don’t have the time or knowledge to take of this task. If you’re up to date on the latest tax regulations and enjoy crunching numbers, it can be a nice business during tax season.

Start a Personal Trainer Business

- Even though healthy is a priority for most of it, it can be a challenge to not only stay on track, but also make sure that exercising is done correctly so that you don’t injure yourself. You can become a personal trainer and motivate and monitor people when they exercise.

Start a business in Importing products

- You can purchase products from overseas in bulk and start selling them at markup. This is a very effective way to start. Increase your spending as you increase your revenues.

Airnb Host

- If you have an extra room or home, then rent it out on Airnb instead of just sitting there vacant. One example, was that one of the clients who use Airnb, was able to make $3,000 per month last year just renting out a room downstairs.

***ARTICLE BASED ON JOHN RAMPTON’S ENTREPRENEUR.COM***

Tips on How Small Businesses Can Become a Firm of the Future

November 2, 2016 by admin

Filed under Business News

How can a business become a firm of the future?

Well let’s take a step back, what does it mean to become a firm of the future?

Let’s look at this example, a firm of the future has been “in business for decades, achieving success using a tried-and-true formula of providing high quality work and or providing great service and product.”

Every year as we all witness the everlasting change of businesses, markets, and demands, we; as business owners sometimes worry about our methodology and business practices in our company.We begin to question if our practices are obsolete now, or are they still working for our business? Then the next question arises, how would we grow the practice while maintaining the winning factors that made the firm what it is? And because of this, many business owners worry too much about these changes and will then take up too much time and money.

Thus, begs the question: How can do we become firms of the future? Well worry no more! As an Orange County CPA, it is our sole duty to provide fresh tips on how you can become a survivalist in the battlefield of business. We have tips here that will help you achieve that!

Do not ever assume that and changes in the market and business world do not apply to you. As George Forsythe states, “even successful and happy firms may not be working as effectively as possible.” Always have a strategic review and assess your plan to measure out the pros and cons to your strategy. If they are working, try to find something that will cause the plan to fail, always assume that there will be change in the future.

Figure out where you stand. Create a transitional step tool that a firm can take in its culture, talent, and clients. Use informal brainstorming to identify steps that can help you move your firm forward.

Set your own priorities. When you start reviewing your firm’s status, be sure to look out for employees who show a lot of promise in their work. Prepare them for the next generation of leaders, this will ensure the security of your company when you are training new leaders.

Do not reinvent the “wheel.” Do not try to create a completely new plan to face the changes your company is facing. Take some of your strategies and create a new way to make them better. Focus on the aspects of creating a simpler, more effective method of that strategy and execute it. Reinventing a new strategy not only makes your employees and partner learn a new method, which takes time, but also, the strategy may not work in this changing marketing and business world.

**ARTICLE BASED ON AICPA.ORG***

How to Start a Business as a Couple, Aww! <3

October 31, 2016 by admin

Filed under Business News

We all know that the benefits of starting a business with a loved one seem obvious: You’re working with someone that you trust, and whom you already you enjoy spending time with. There are plenty of high profile success stories- Cisco, Slideshare, and Popsugar were all started by couples-to serve as inspiration for marrying business and love. But even the best partnerships can be strained by the stresses of running a business. Finding dedicated time for a relationship when there are shared work responsibilities to be delegated, staff to be managed, and conflicts to be resolved is no joke. And that’s why when things go wrong, perhaps nobody has it worse than partner who are both in love and in business. The stakes can be so much higher.

Let’s take an example, Heather and Allan Staker used to have date nights. Then the married couple launched a startup together. “Friday date night would turn into eating Indian food in front of our laptops” Heather says. “I was starting to feel overwhelmed – we were always together, but we were always working. I went to see a life coach, who told me, “you’ve got to stay in love with each other, apart from your business.” So they came up with a rule; No computers on date nights. It wasn’t easy, but they stuck to it. And with technology banished, their special dinners became a time to connect and talk as spouses rather than as cofounders.

So how can you start a business as a couple successfully?

– Start with A Plan

- For many couples, starting a business together feels natural: The idea most likely came out of the relationship. One example is that a couple can start to figure all of the work together and sort them out into tasks for each individual in the relationship. What do we mean by that? Have the husband work a series of tasks while the wife works on another series of tasks. Plan out these tasks together, and then assign them whoever does the tasks.

– Keep It Professional

- Once a couple both go full time together for their business, there would be constant closeness between the two. Although the privacy for the both of them to be intimate with each other is going to be less than before, it is still necessary to stay professional for the sake of the employees and the business. Keeping it professional instead of calling each other “babe” or other silly words would make the work environment more product, you never know, one of your employees may be feeling lonely with their love lives.

– Set Expectations Early

- Before pouring all your coupled energy into a budding business, it’s important to set parameters of where work ends and where life begins. For the Staker’s (Indian Food example), the no laptop rule was a romance life saver and it inspired additional at-home rules. For some others, the marriage becomes all about the work- and that can be ok too. An added benefit of married business partners is not being nagged on the weekend or on vacation to unplug, as spouses often do. A cofounder gets how impossible that is – and they’re right there next to you, clicking through emails. Make plans to do things together other than work to keep the relationships alive while keeping the business running well.

***ARTICLE BASED ON ENTREPRENEUR APRIL 2016***

IRS Scam Update: U.S charges 61 over India-based Impersonation Scam

October 28, 2016 by admin

Filed under Business News

In one of our earlier posts, we posted up a blog about how we can identify a fraudulent scam from a fake IRS representative.

Just recently, The US Justice Department charged 61 people and entities on Thursday on October 27, 2016 with taking part in a scam involving India-based call centers where agents impersonated Internal Revenue Service (IRS) where immigration and other federal officials and demanded payments for nonexistent debts.

The scam, which had operated since 2013, targeted at least 15,000 people who lost more than $300 million. Twenty people were arrested in the United States on Thursday while 32 individuals and five call centers in India have been charged, the department said in statement.

The defendants, including 24 people across nine U.S states, were indicted by a grand jury in the United States District Court for the Southern District of Texas.

United States Assistant Attorney General Leslie Caldwell said at a news conference that the United States will be seeking extradition of those based in India and warned others engaged in similar schemes.

“It’s really important for the scammers in India to know that the United States is looking at this, is watching them and they could, if they engage in that activity, be extradited to the United Sates and could sit in jail … for several years,” she said.

According to the indictment, the operators of the call centers in Ahmedabad, in the Indian state of Gujarat, “threatened potential victims with arrest, imprisonment, fines or deportation if they did not pay taxes or penalties to the government.”

Payments by victims were laundered by a U.S. network of co-conspirators using prepaid debit cards or wire transfers, often using stolen or fake identities, the statement said.

The call centers also ran scams in which victims were offered short-term loans or grants on condition of providing good-faith deposits or payment of a processing fee, it said.

The Investigation involved immigration and Customs Enforcement, Treasury, Homeland Security, U.S Secret Service and police officials, the Justice Department said.

***ARTICLE BASED ON REUTERS.COM***

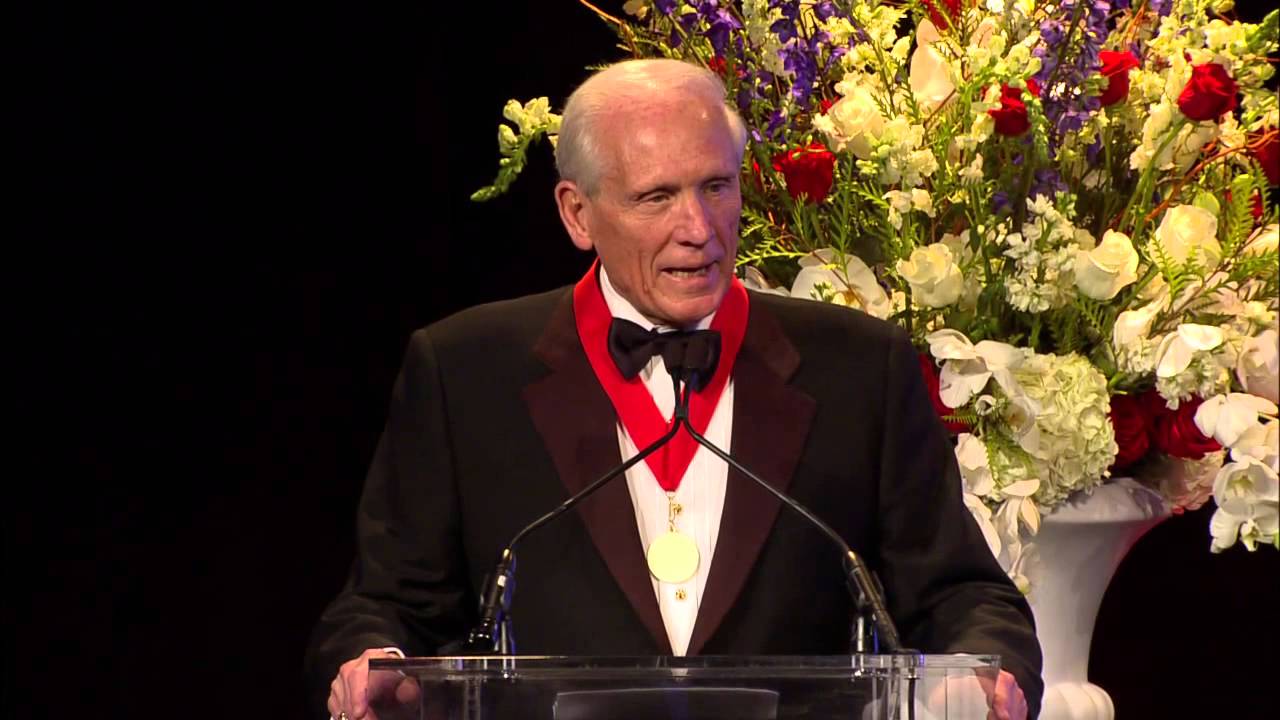

From World Ranked Swimmer to Successful Entrepreneur

October 26, 2016 by admin

Filed under Business News

We would like to share this story with you because this man shares similar values as we do as our company, and we want to show you how integrity takes each of us a long way in the business world.

Joseph M. Grant, a world class swimmer in his youth during the early 1960’s had an intensive work ethic. For those of you who do not know who he is, he was someone who became one of the most successful business men during his time of the century for someone who did not have a background business during his youth.

The main point of this blog is to inspire entrepreneurs that anyone from any background can become a successful business person. Although some of the articles written previously became successful in the creative aspect of the business, this man became a successful in the technical side of business. Technical business side is a very challenging feat, as it requires a lot of studying and education in order to become knowledgeable where you can turn that knowledge into business. This man was able to achieve that with hard work and dedication.

In the early 1970’s Grant credits the discipline that he used in his intense training as the foundation for his later successes. He also firmly believes that his unwavering ethical compass has allowed him to start a commercial banking empire with the most well-funded startup of any such bank in history. This same moral compass brought him to the brink of financial disaster in his personal life.

During the early 1980’s, Grant achieved his life’s goal when he appointed CEO and chairman of Texas American Bancshares, a prominent Texas banking company. He has spent his entire career preparing himself for this opportunity and had plans to take the bank to even higher levels of prosperity. When the outgoing chairman announced his successor, he also announced the first quarterly loss in the company’s 113-year history. Unfortunately for Grant, things did not get better. The bank’s assets were firmly concentrated in the oil industry in the southwestern U.S and world oil market fluctuations were wreaking havoc.

He faced anger form customers and investors. He also had to deal with the suicide of one of his senior officers. The stress and negative outlook were overwhelming in intensity. Grant had been a good corporate citizen and had invested heavily of his personal wealth in the bank. As the bank’s fortunes dwindled, so did his own. There were many opportunities to simple pack up his office, sell off his holdings, take his dished wealth and move on. He was encouraged to do so by members of his family and his friends. His essential decency would not allow him to do this. However, he saw himself as the captain of the ship and felt he was obligated to go down with it. He saw the bank seized by federal banking officials. Ultimately, the holding company entered bankruptcy and was sold. Only then, did he allow himself to move on. He lost everything.

Grant moved on. He became the CFO (chief financial officer) of Electronic Data Systems Corp. in 1990 and saw that company through a difficult spin off from General Motors Corp. later that same decade. He retired from Electronic Data Systems Corp and surprisingly, despite the trauma he had suffered with Texas American Bancshares, he moved back into the banking industry. He founded Texas Capital Bancshares and ended up with $80 million from his startup.

The purpose of this story is to understand that Grant firmly believes that his reputation for strict integrity and his willingness to lay everything on the line by refusing to bend the rules was the reason he was able to successfully raise the money for the new bank. To put it simply, people trusted him and trusted that he would always do the right thing.

Wait! Before You Gift Someone Something, Know That Gift Taxes Exist!

Did you know that gift taxes exist?

Let’s imagine that you own a brand new Nissan GTR, and you plan to pass that vehicle down to your family like your son. After going to the DMV to file a transfer and sending the vehicle registration, the IRS will know that you have made this transfer and will include a gift tax on your tax statement at the end of the year. Your son who received the car, will not be paying any taxes. Regardless of who the receiver is, the sender will pay additional tax for gifting them an item.

That’s really unfair of them to impose isn’t it?

Well, thanks to some of our great CPA firms in Orange County, they can educate you on these gift taxes. It is pretty certain that most people do not know what these gift taxes are, and we are pretty confident that this will be useful for most of you.

WHO PAYS THE GIFT TAX?

Normally, people who pay the tax gifts are generally responsible for the paying the gift tax. However, the receiver may agree to pay the tax instead. Visit any CPA in Orange County or tax professional if you are looking for this type of arrangement.

But what is considered a gift? Well anything is taxable really. It can go from homes, property, cars, toys, food, furniture, you name it!

There are many exceptions to this rule however –

EXCEPTIONS TO GIFT TAXING

Any gifts that are not more than the annual exclusion for the calendar year. What does that mean? Let’s take a rich person for example, the annual exclusion for 2011 was $13,000, that means that this rich person can gift $13,000 to 10 different people in one year without incurring a gift tax in their statement.

If you gift a tuition or medical expenses by paying for someone, then gift taxes would be excluded.

If you gift to your spouse, you will be exempt from gift taxes.

And finally, gifting to a political organization or charitable organization.

CAN YOU DEDUCT GIFTS ON THE TAX RETURN?

If you make a gift or leave your estate to your receivers of the gift, they will not ordinarily affect your federal income tax. You cannot deduct the value of the gifts you make (Other than gifts that are deductible charitable contributions). If you are not sure whether the gift tax or the estate tax applies in your situation, please see CPA Orange County for advice.

Annual Exclusions vary each year, since we are currently in the 2016 year, our annual exclusion is $14,000. However, if you and your spouse own an item or property together, you are both entitled to the annual exclusion of $14,000 each, thus a total of $28,000 can be excluded.

Who should I hire to represent me and prepare and file the return? Since the IRS cannot make recommendations about specific individuals, there are several factors to consider:

– The complexity of the transfer

– The size of the transfer (in terms of dollar amount)

– CPA Orange County firms

People who make gifts as part of their overall estate and financial plan often engage the services of CPA professionals in Orange County.

California—Personal Income Tax: Supplemental Documentation Did Not Substantiate Claimed Deduction Amounts.

Supplemental documentation provided by taxpayers regarding their claimed California personal income tax deductions for ordinary and necessary expenses paid or incurred in carrying on a trade or business was not sufficient to overcome the presumption that the Franchise Tax Board’s determinations, based on a federal audit report, were correct.

With regard to their claimed vehicle expenses, the taxpayers did not identify the source of the document they provided that showed a schedule of vehicle payments, and the document was not accompanied with underlying documentation verifying the information on it. With regard to their claimed office expenses, although a tenant ledger was provided that indicated payments for rent and utilities, nothing in that document showed that those amounts were not included in the office expenses already allowed as a deduction. With regard to their claimed education expenses, an unofficial university transcript, which did not contain the taxpayer-husband’s name or other identifying information, and did not include any information regarding amounts paid for the course work described on the transcript, was not sufficient documentation to substantiate the deduction. Finally, with regard to their claimed travel expenses and meals or entertainment expenses, the taxpayers did not provide any additional documentation or legal argument to support those claimed deductions, so they did not establish that they were entitled to those deductions.

Please contact www.sonnycpa.com if you need additional information.

California—Personal Income Tax: FTB Contacting Nonfilers

The California Franchise Tax Board (FTB) is contacting more than 1 million people who did not file a 2011 state income tax return. The deadline to file was October 15, 2012. The FTB compares its records of filed tax returns with the more than 400 million income records it receives each year from the Internal Revenue Service, banks, employers, state departments, and other sources. The FTB also uses occupational licenses and mortgage interest payment information to detect others who may have a requirement to file a state tax return. Contacted individuals have 30 days to file a state tax return or show why one is not due. If a required return is not filed, the FTB will issue a tax assessment using income records to estimate the amount of state tax due. The assessment will include interest, fees, and penalties.

Tax-Free IRA Distributions

The American Taxpayer Relief Act of 2012 (2012 Taxpayer Relief Act) extends through 2013 the provision which allows individuals who are at least 70½ by the end of the year to exclude from gross income qualified charitable distributions up to $100,000 from a traditional or Roth IRA that would otherwise be included in income. Married individuals filing a joint return are allowed to exclude a maximum of $200,000 for these distributions ($100,000 per individual IRA owner).

A review of your tax return indicates that you may be eligible to take advantage of these opportunities. As you may know, IRA owners must either withdraw the entire balance or start receiving periodic distributions from their traditional IRAs by April 1 of the year following the year in which they reach age 70-1/2. The distribution that is required each year is computed by dividing the IRA account balance as of the close of business on December 31 of the preceding year by the applicable life expectancy. An IRA owner who does not make the required withdrawals may be subject to a 50-percent excise tax on the amount not withdrawn.

2012 Resolves Many Uncertainties

2012 Resolves Many Uncertainties, Creates Others; Sets Stage For Future Tax Reform.

Uncertainty during 2012 over what tax laws would govern in 2013 and beyond because of the expiring Bush-era tax cuts clearly was the most significant development of the year. Now that Congress and President Obama — through the American Taxpayer Relief Act of 2012 (ATRA) — have provided a degree of certainty over tax rates into at least the immediate future, taxpayers need to adjust their tax plans accordingly. Individuals and businesses should immediately recalibrate strategies in light of ATRA. 2012 was also a significant year for important tax developments from the Treasury Department, the IRS and the courts. These developments demand the attention of individual and business taxpayers not only to caution what is no longer allowed under the tax laws but also to shape what steps can be taken in 2013 and beyond to maximize tax savings. With that forward-looking perspective, this Tax Briefing reviews key federal tax developments that took place during 2012.

3.8 Percent Medicare Tax on Investment Income

The health care reform package (the Patient Protection and Affordable Care Act and the Health Care and education Reconciliation Act of 2010) imposes a new 3.8 percent Medicare contribution tax on the investment income of higher-income individuals. Although the tax does not take effect until 2013, it is not too soon to examine methods to lessen the impact of the tax. Certain year-end strategies might also be considered to avoid the tax, such as accelerating capital gains and other investment income into 2012 or converting a portion of your investments into tax-exempt interest.

Net investment income. Net investment income, for purposes of the new 3.8 percent Medicare tax, includes interest, dividends, annuities, royalties and rents and other gross income attributable to a passive activity. Gains from the sale of property that is not used in an active business and income from the investment of working capital are treated as investment income as well. However, the tax does not apply to nontaxable income, such as tax-exempt interest or veterans’ benefits. Further, an individual’s capital gains income will be subject to the tax. This includes gain from the sale of a principal residence, unless the gain is excluded from income under Code Sec. 121, and gains from the sale of a vacation home. However, contemplated sales made before 2013 would avoid the tax.

The tax applies to estates and trusts, on the lesser of undistributed net income or the excess of the trust/estate adjusted gross income (AGI) over the threshold amount ($11,200) for the highest tax bracket for trusts and estates, and to investment income they distribute.

Deductions. Net investment income for purposes of the new 3.8 percent tax is gross income or net gain, reduced by deductions that are “properly allocable” to the income or gain. This is a key term that the Treasury Department expects to address in guidance, and which we will update you on developments. For passively-managed real property, allocable expenses will still include depreciation and operating expenses. Indirect expenses such as tax preparation fees may also qualify.

For capital gain property, this formula puts a premium on keeping tabs on amounts that increase your property’s basis. It also puts the focus on investment expenses that may reduce net gains: interest on loans to purchase investments, investment counsel and advice, and fees to collect income. Other costs, such as brokers’ fees, may increase basis or reduce the amount realized from an investment. As such, you may want to consider avoiding installment sales with net capital gains (and interest) running past 2012.

Thresholds and impact. The tax applies to the lesser of net investment income or modified AGI above $200,000 for individuals and heads of household, $250,000 for joint filers and surviving spouses, and $125,000 for married filing separately. MAGI is AGI increased by foreign earned income otherwise excluded under Code Sec. 911; MAGI is the same as AGI for someone who does not work overseas.

The tax can have a substantial impact if you have income above the specified thresholds. Also, don’t forget that, in addition to the tax on investment income, you may also face other tax increases proposed by the Obama administration that could take effect in 2013. The top two marginal income tax rates on individuals would rise from 33 and 35 percent to 36 and 39.6 percent, respectively. The maximum tax rate on long-term capital gains would increase from 15 percent to 20 percent. Moreover, dividends, which are currently capped at the 15 percent long-term capital gain rate, would be taxed as ordinary income. Thus, the cumulative rate on capital gains would increase to 23.8 percent in 2013, and the rate on dividends would jump to as much as 43.4 percent. Moreover, the thresholds are not indexed for inflation, so a greater number of taxpayers may be affected as time elapses. Congress, together with a new administration, may step in and change these rate increases, but the possibility of rates going up for upper income taxpayers is sufficiently real that tax planning must take them into account.

Please contact our office if you would like to discuss the tax consequences to your investments of the new 3.8 percent Medicare tax on investment income.

Taxpayers who did not establish insolvency must recognize COD income

Taxpayers who settled a credit card debt for $4,412 less than they owed in 2008 had to include that amount in income because they did not prove they were insolvent under Sec. 108(a)(1)(B) at the time of the debt discharge (Shepherd, T.C. Memo. 2012-212).

Sec. 108(a)(1)(B) excludes cancellation of debt (COD) income from gross income if the debt discharge occurs while the taxpayer is insolvent. The taxpayers, Bernard and Desiree Shepherd, claimed to be insolvent in 2008 when the credit card company cancelled their debt. At issue in the case was the fair market value (FMV) at the time of the debt discharge of two pieces of real estate the Shepherds owned: their principal residence and their vacation home. In addition, the parties disagreed whether the value of Bernard Shepherd’s state pension should be included in the taxpayers’ assets when calculating the insolvency.

The valuation of these assets would determine whether the value of taxpayers’ liabilities exceeded the total value of their assets, and therefore whether they were insolvent. If the Tax Court accepted the taxpayers’ valuation of their houses and excluded the pension loan from their liabilities (and the corresponding amount of the balance in the pension from their assets), petitioners would be approximately $32,000 insolvent and therefore would not be required to include the COD income in their income for 2008.

Self-employed can deduct Medicare premiums

Explaining a recent reversal of a long-held IRS stance, the Office of Chief Counsel advised IRS attorneys on Friday that self-employed individuals may deduct Medicare premiums from their self-employment income. Chief Counsel Advice (CCA) 201228037 clarifies an IRS position that previously has appeared only in instructions to Form 1040, U.S. Individual Income Tax Return, and IRS publications for tax years 2010 and forward allowing the deduction.

Taxpayers who failed to deduct Medicare premiums for prior tax years within the statute of limitation may file amended returns to claim the deduction.

Before tax year 2010, Form 1040 instructions for line 29 stated, “Medicare premiums cannot be used to figure the [self-employed health insurance] deduction.” Before 2010, Publication 535, Business Expenses, stated that Medicare Part B premiums were not deductible as a business expense, in keeping with Field Service Advisory (FSA) 3042, issued in 1995.

For the 2010 Form 1040, the instructions for line 29 were changed to specify, “Medicare Part B premiums can be used to figure the deduction.” The 2010 version of Publication 535 was similarly amended, but the IRS offered no guidance or explanation for the change.

Sec. 162(l)(2)(A) limits the deductible amount of payments made for health insurance to the taxpayer’s earnings from the trade or business “with respect to which the plan providing the medical care coverage is established.” FSA 3042 stated that this meant that payments under a plan that is not established with respect to the taxpayer’s trade or business (specifically including Medicare Part B, because it is a federal program) are not deductible.

Married Taxpayer Filing Separately Not Entitled to Full Deduction

Married Taxpayer Filing Separately Not Entitled to Full Deduction of $1.1 Million for Mortgage Interest.

A taxpayer who elects married filing separately is limited to a deduction for interest paid on $500,000 of home-acquisition indebtedness plus interest paid on $50,000 of home-equity indebtedness, the Tax Court has ruled (Bronstein v. Commissioner, Dec. 59,060, 138 TC No. 21).

The Tax Court found that the statutory language on acquisition indebtedness and home-equity indebtedness is clear on its face. A married individual filing a separate return is limited to a deduction for interest paid on $500,000 of home-acquisition indebtedness. Likewise, a married individual filing a separate return is limited to a deduction for interest paid on $50,000 of home-equity indebtedness. The taxpayer offered no evidence to override this language and have the $1 million and $100,000 limits apply to the returns of married taxpayers filing separately.

Business and Tax News

President Signs Highway/Student Loan Bill (Jul. 9, 2012).

President Obama on July 6 signed the Moving Ahead for Progress in the 21st Century Act (MAP-21) (HR 4348 ), which raises $20.4 billion in revenue and reauthorizes the fuel and ticket excise taxes that support the Highway Trust Fund through the end of fiscal year 2014. The bill raises $9.4 billion by stabilizing interest rates for pension funds and about $9.8 billion from changes to single-employer pension plans.

Obama Plugs Extension of Middle-Class Tax Cuts.

President Obama on July 9 reiterated his call for a one-year extension of the Bush-era tax cuts for those earning under $250,000 per year, but it does not appear likely that Republicans will go along as they continue to insist on a one-year extension for all taxpayers, including the wealthy. No one should see an income tax hike next year—not families, not small businesses and other job creators.

White House Renews Call to Increase Enhanced Small Business Expensing After 2012 (Jul. 12, 2012).

The White House renewed its support for enhanced Code Sec. 179 expensing on July 11. Senior Obama administration officials announced the proposal and related initiatives for small businesses during a conference call with reporters. Under current law, the Code Sec. 179 dollar limit for tax years beginning in 2012 is $139,000 and the investment limitation is $560,000.