Spend More Time With Your Family & Friends while saving money for the Holidays

December 23, 2016 by admin

Filed under Business News

It’s that time of the year again where many of us celebrate the holidays with cheer, parties, gifts, and many other goods to enjoy before they hit reality again. But guess what, you know what else comes after those parties, gifts, and goods? That’s right! A hefty bill in the New Year!

You’re probably thinking, “Oh thanks a lot Sonny, I definitely needed that reassurance…” Well hold on there, we’re not here to deliver bad news to you! We have some great money saving tips that will help you save money so it’ll at least soften up that bill in January.

According to moneyadviceservice.org, the average Christmas spent per household is around $615, which includes food, presents, travel, and decorations. Based on moneyadviceservice.org, they have compiled a list of steps on how you can save money for the Holidays:

Step 1 – Set a Budget – Making a list of family and friends you will be buying for will help you organize how much you will spend on each person. We recommend using a Microsoft Excel spreadsheet so you can calculate how much you have to spend, and include tax rates as well. Additionally, if you are hosting dinner then think about how many people will be coming over and how much you will be spending on what you will be offering in the party to your guests.

Step 2 – Work out how much to save each month – Make a commitment to save a portion of your income or cash flow every month. If you commit to saving a certain amount every month consistently, you will notice that you have a lot more money than you think without even realizing it. It really feels like you hit a jackpot in a slot machine game!

Step 3 – Start some new Christmas traditions – Perhaps starting some new Christmas traditions where the whole family or friends can join in with while saving along the way will help save money, since they are going to pitch in the expenses. A good tip on saving, instead of writing out gift cards to friends and family, you can send e-gift cards through email. We are living in the digital age, and most people are heavily reliant on digital devices and phones these days. Not only will you save money on buying gift cards, you will also save a lot of time, in which you can use to spend that extra time with those who matter to you most. If you are buying gifts for friends, you can set a limit on how much you spend, or even better, you can use the extra time you have (Assuming you use e-cards) to make a handmade present, nobody loves a handmade present more than a purchased gift.

Step 4 – Decide where to put your Christmas Savings – For those who want to save smaller amounts of money, you can simple place your savings in a coin jar. However, be sure to transfer it into a savings account once it gets full. Setting up a bank account that is used for instant savings would help as well.

Well, that’s it folks! Sonny & Company CPA wishes you Happy Holidays, and we hope you are all able to enjoy the end of the year with your loved ones! We hope these tips will help you. Save, party, and enjoy like there’s no tomorrow! Happy New Year!

Happy Holidays! Year-End Tax Saving Tips to Spend or Save for the Holidays

It looks like the end of the year is coming, and we are pretty sure many of you are still frantically shopping for gifts for your family and friends. Do you ever wish you had more money to spend for your friends and family, but just could not figure out how you can save more money?

Well have no fear! We are an Orange County CPA firm who will be here to provide tips on how you can cut tax spending to save or have more money to spend for you your loved ones.

Capital Gains and Dividends. The tax rate on qualified capital gains (net-long term gains) and dividends range from 0 – 20%, depending on the individuals income tax bracket.

STRATEGY: Spikes in income, whether capital gain or other income, may push gains into either the 39.6 percent bracket for short-term gain or the 20% capital gains bracket. Spending the recognition of certain income between 2016 and 2017 may help minimize the total tax paid for the 2016 and 2017 tax years.

State and local sales tax deduction. The PATH Act made permanent the itemized deduction for state and local general sales taxes. That deduction may be taken in lieu of state and local income taxes when itemizing deductions.

STRATEGY: Generally IRS tables based upon federal income levels and a taxpayer’s number of departments are used for this optimal deduction. Taxpayers who wish to claim more than the table amounts must provide adequate substantiation.

Tuition and fees deduction. The PATH Act extended the above-the-line deduction for qualified tuition and related expenses for two years, for expenses paid before January 1, 2017. The maximum amount of the tuition and fees deduction is $4,000 for an individual whose AGI (Adjusted Gross Income) for the tax year does not exceed $65,000 ($130,000 in the case of a joint return), or $2000 for other individuals who’s AGI does not exceed $80,000 ($160,000 in the case of a joint return)

STRATEGY: Payments by year-end 2016 may be particularly critical to taking this deduction. There is some – but not unlimited – flexibility regarding the deductibility of tuition paid before a semester begins. As with the AOTC, the deduction is allowed for expenses paid during a tax year, in connection with an academic term beginning during the year or the first three months of the next year.

Nonbusiness energy property credit. The PATH Act extended the nonrefundable non business energy property credit allowed to individuals, making it available or qualified energy improvements and property placed in service before January 1, 2017.

STRATEGY: Several overall limitations apply. A credit amount for qualified energy efficiency improvements equals 10 percent of the amount paid or incurred during the tax year and 100% of the amount paid or incurred for qualified energy property during the tax year. The maximum credit amount for qualified energy property varies depending on the type of property, further all nonbusiness energy property carries a $500 maximum lifetime credit cap.

Individual Shared Responsibility Payments. For 2016, the individual shared responsibility payment is the greater of 2.5% of house-hold income that is above the tax return filing threshold for the individual’s filing status or the individual’s flat dollar amount, which is $695 per adult and 347.50 per child, limited to a family maximum of $2,085, but capped at the cost of the national average premium for a bronze level health plan available through the Marketplace in 2016.

STRATEGY: Open enrollment for coverage through the Health Insurance Marketplace for 2016 has closed. However, some qualifying life events may make an individual eligible for non-filing season special enrollment.

Medical expense deduction. Taxpayers who itemized deductions (for regular tax purposes) may claim a deduction for qualified reimbursed medical expenses to the extent those expenses exceed 10% of adjusted gross income (AGI), unless the tax payer falls within an age-based exception. Taxpayers (or their spouses) who are aged 65 or older before the close of the tax year, may apply the old 7.5% threshold for tax years but only through 2016.

STRATEGY: Tax payers who are age 65 or older may consider accelerating medical costs into 2016 if they want to itemize deductions since the AGI floor for deductible expense rise from 7.5% to 10% in 2017. For deductions by cash-basis taxpayers in general, including for purposes of the medical expense deduction, a deduction is permitted only in the year in which payment for services rendered is actually made.

How Hard is it to Invest in Real Estate?

December 1, 2016 by admin

Filed under Entrepreneurship

There was an interesting article written by Scott Trench who recently wrote an article about how easy it is to invest in Real Estate. In the beginning he talks about how some of the most successful entrepreneurs started off with nothing. That’s a very typical story of how entrepreneur’s become millionaires. Many of us has read many stories about these successful people, but what about working class or middle class people?

In this article, he personally talks about how he was able to achieve his financial freedom through gradual investment of real estate while working his full time job that he personally loves, while making medium to medium high income. It is true that most people would love to live that kind of lifestyle of being able to make additional money on the side while making money from their jobs that they love. That is the dream! However, later in the article he talks in detail about how every single investment always has a risk, which is true! Any investment always comes with risk, no matter how big or small. Additionally, there is some commitment involved, which is one of the reasons most people could not leave their jobs to pursue an investment journey to reach financial freedom.

At the end of the article, Trench states that real estate investing does not have to be so hard. Although there are some instances where it is easy if you make it to be. There are a few considerations to think about before you get into investing property.

The Good, Bad, and Ugly of Real Estate Investments states that knowing your market well would be beneficial. Looking for deals that are underpriced for one reason or another would be a good idea, because you won’t know which deals are underpriced unless you have a good sense of how properties are priced.

And another problem that you may have to consider is who the tenants are. There are some stories where tenants would bring in stolen merchandise into the property and store them in there. Another instance would be, party goers, they may wreck your property which will incur many costs and repairs, which will cost more than what you are earning from them for rental payment. And another is when tenants treat your property like its theirs, painting the homes, adding unnecessary items to the home that stays in the home etc. Lesson here is to make sure to check your tenants on a frequent basis.

Overall, investing can be easy, but always remember to consider some of these facts as they can be very helpful in your future obstacles that you may face when you invest in real estate.

**Article Based on Biggerpockets.com**

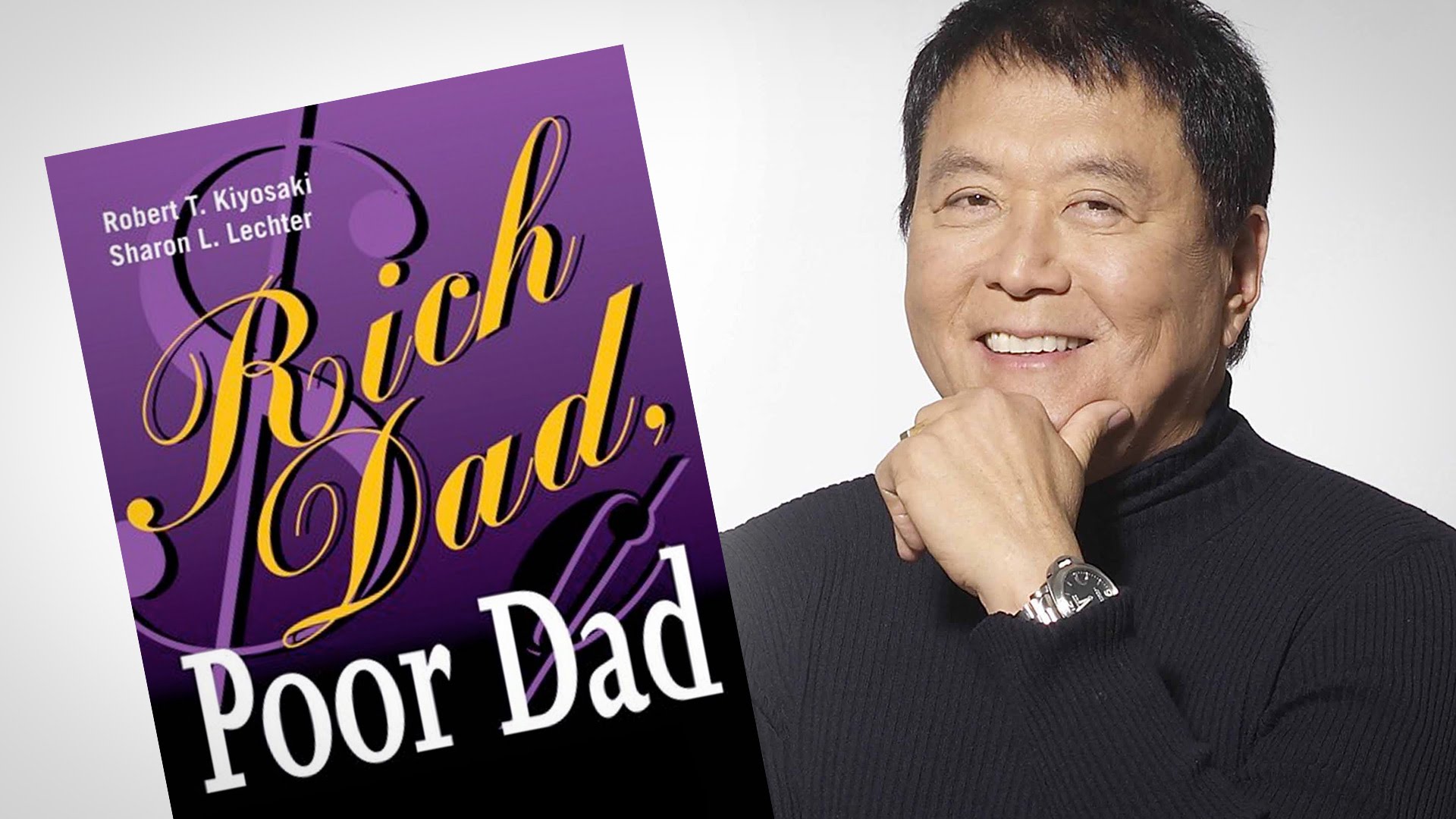

The Lesson from Rich Dad, Poor Dad

November 28, 2016 by admin

Filed under Entrepreneurship

“Many people work very hard, but they never seem to earn enough. In Rich Dad, Poor Dad, Robert Kiyosaki explains how to escape this “rat race” and achieve financial independence.”

When you are trying to aim for financial independence, people would think that going to school getting high grades and getting a good job would be the answer to all your financial problems right? Well, if you think that’s the way to go, then you probably shouldn’t be reading this. Just kidding! It’s just a sarcastic comment. According to Rich Dad, Poor Dad, Robert Kiyosaki claims that the education system is the number one cause of why so many people struggle financially. Schools teach people how to work for money, but they do not teach them how money can work for them. For example, Orange County is one of the richest counties in United States and yet many people within that county are not really good at handling their money to a certain extent, that is why they look for Orange County CPA firms and depend on them to manage their money. Although Orange County CPA firms are very useful and helpful, the lack of financial skills taught in school for these people means that even highly educated people generally do not know how to handle their money. The results are that the majority of people are trapped in work to pay their bills and are chasing paychecks all their life.

Unfortunately, Robert Kiyosaki claims this as his sad conclusion. Luckily, he also offers a way out of this loop. The essential element with working for money is that a job is a short term solution to a long term problem. People strongly believe that if they get a promotion or a raise, or get a new job, they will finally have enough to live financially. However, if you do not know how money works, you can never have enough money alone will not solve anything. It will even get most people into more debt. So what is the secret to financial independence?

The secret is actually quite simple: “Know what an asset is, acquire them and become rich.” (Kiyosaki) Sounds easy right? Heres the hard part though, most people are not appropriately taught how to spend their money. Many do you not know the difference between an asset, which is something that puts money in your pocket, and a liability, which is something that takes money out of your pocket. Kyosaki’s main point is that the only way to become financially independent is to accumulate income generating assets which can pay for your expenses. Unfortunately, many people would rather buy a new car or a phone instead of investing their money in stocks or real estate.

If you do not want money to control you like it does most people, then you will have to do things differently from the crowd.

We would highly recommend reading Robert Kiyosaki’s book Rich Dad, Poor Dad, it is very interesting, gives you a different perspective in life, and it is very educational.

***ARTICLE BASED ON VALUESPREADSHEET.COM WRITTEN BY NICK KRAAKMAN***

U.S. Consumer Spending Rises, Brexit Casts Shadow on Outlook

June 30, 2016 by admin

Filed under Business News

U.S. consumer spending rose for a second straight month in May on increased demand for automobiles and other goods, but there are fears Britain’s vote to leave the European Union could hurt confidence and prompt households to cut back on consumption.

Despite the healthy consumer spending, Brexit made it unlikely that the Federal Reserve would raise interest rate soon. The U.S. central bank needed to be sure there was no shock from the outcome of the British referendum before tightening monetary policy further. The dollar fell against a basket of currencies, while prices for longer-dated U.S. government debt rose.

Consumer spending, which accounts for more than two-thirds of U.S. economic activity, increased 0.4 percent last month after surging 1.1 percent in April. The economy is doing well. However, there are many uncertainties in the market. Therefore, consumers and business should watch out for their spending or expansion in the next quarter.