The Lesson from Rich Dad, Poor Dad

November 28, 2016 by admin

Filed under Entrepreneurship

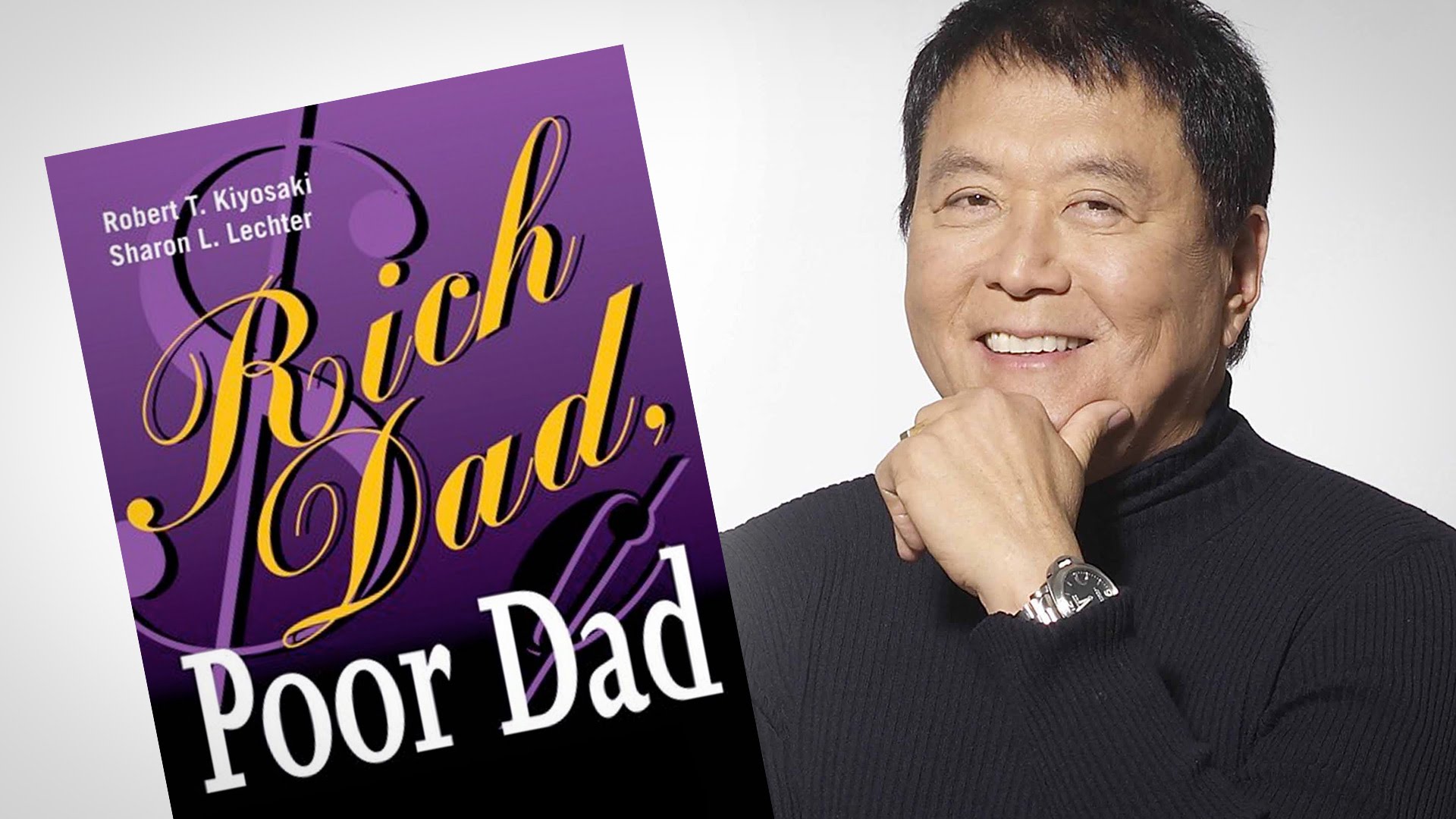

“Many people work very hard, but they never seem to earn enough. In Rich Dad, Poor Dad, Robert Kiyosaki explains how to escape this “rat race” and achieve financial independence.”

When you are trying to aim for financial independence, people would think that going to school getting high grades and getting a good job would be the answer to all your financial problems right? Well, if you think that’s the way to go, then you probably shouldn’t be reading this. Just kidding! It’s just a sarcastic comment. According to Rich Dad, Poor Dad, Robert Kiyosaki claims that the education system is the number one cause of why so many people struggle financially. Schools teach people how to work for money, but they do not teach them how money can work for them. For example, Orange County is one of the richest counties in United States and yet many people within that county are not really good at handling their money to a certain extent, that is why they look for Orange County CPA firms and depend on them to manage their money. Although Orange County CPA firms are very useful and helpful, the lack of financial skills taught in school for these people means that even highly educated people generally do not know how to handle their money. The results are that the majority of people are trapped in work to pay their bills and are chasing paychecks all their life.

Unfortunately, Robert Kiyosaki claims this as his sad conclusion. Luckily, he also offers a way out of this loop. The essential element with working for money is that a job is a short term solution to a long term problem. People strongly believe that if they get a promotion or a raise, or get a new job, they will finally have enough to live financially. However, if you do not know how money works, you can never have enough money alone will not solve anything. It will even get most people into more debt. So what is the secret to financial independence?

The secret is actually quite simple: “Know what an asset is, acquire them and become rich.” (Kiyosaki) Sounds easy right? Heres the hard part though, most people are not appropriately taught how to spend their money. Many do you not know the difference between an asset, which is something that puts money in your pocket, and a liability, which is something that takes money out of your pocket. Kyosaki’s main point is that the only way to become financially independent is to accumulate income generating assets which can pay for your expenses. Unfortunately, many people would rather buy a new car or a phone instead of investing their money in stocks or real estate.

If you do not want money to control you like it does most people, then you will have to do things differently from the crowd.

We would highly recommend reading Robert Kiyosaki’s book Rich Dad, Poor Dad, it is very interesting, gives you a different perspective in life, and it is very educational.

***ARTICLE BASED ON VALUESPREADSHEET.COM WRITTEN BY NICK KRAAKMAN***

How to Start a Business as a Couple, Aww! <3

October 31, 2016 by admin

Filed under Business News

We all know that the benefits of starting a business with a loved one seem obvious: You’re working with someone that you trust, and whom you already you enjoy spending time with. There are plenty of high profile success stories- Cisco, Slideshare, and Popsugar were all started by couples-to serve as inspiration for marrying business and love. But even the best partnerships can be strained by the stresses of running a business. Finding dedicated time for a relationship when there are shared work responsibilities to be delegated, staff to be managed, and conflicts to be resolved is no joke. And that’s why when things go wrong, perhaps nobody has it worse than partner who are both in love and in business. The stakes can be so much higher.

Let’s take an example, Heather and Allan Staker used to have date nights. Then the married couple launched a startup together. “Friday date night would turn into eating Indian food in front of our laptops” Heather says. “I was starting to feel overwhelmed – we were always together, but we were always working. I went to see a life coach, who told me, “you’ve got to stay in love with each other, apart from your business.” So they came up with a rule; No computers on date nights. It wasn’t easy, but they stuck to it. And with technology banished, their special dinners became a time to connect and talk as spouses rather than as cofounders.

So how can you start a business as a couple successfully?

– Start with A Plan

- For many couples, starting a business together feels natural: The idea most likely came out of the relationship. One example is that a couple can start to figure all of the work together and sort them out into tasks for each individual in the relationship. What do we mean by that? Have the husband work a series of tasks while the wife works on another series of tasks. Plan out these tasks together, and then assign them whoever does the tasks.

– Keep It Professional

- Once a couple both go full time together for their business, there would be constant closeness between the two. Although the privacy for the both of them to be intimate with each other is going to be less than before, it is still necessary to stay professional for the sake of the employees and the business. Keeping it professional instead of calling each other “babe” or other silly words would make the work environment more product, you never know, one of your employees may be feeling lonely with their love lives.

– Set Expectations Early

- Before pouring all your coupled energy into a budding business, it’s important to set parameters of where work ends and where life begins. For the Staker’s (Indian Food example), the no laptop rule was a romance life saver and it inspired additional at-home rules. For some others, the marriage becomes all about the work- and that can be ok too. An added benefit of married business partners is not being nagged on the weekend or on vacation to unplug, as spouses often do. A cofounder gets how impossible that is – and they’re right there next to you, clicking through emails. Make plans to do things together other than work to keep the relationships alive while keeping the business running well.

***ARTICLE BASED ON ENTREPRENEUR APRIL 2016***

IRS eyes payroll tax avoidance tactics via S corporations

Payroll tax collection continues to vex the Internal Revenue Service despite several court cases that have resulted in rulings favorable for the IRS regarding unreasonably low compensation. A recent high profile case was David E. Watson, P.C. v. United States on which the Eighth Circuit ruled in 2012. Watson was an indirect partner in a CPA firm, practicing through an S corporation that paid him $24,000 of salary per year and between $175,000 and $203,000 in profit distributions. The court adjusted his compensation to $93,000.

It isn’t hard to see why shareholders of S corporations attempt to justify wage levels below what the IRS considers “reasonable compensation” (assuming the understated compensation is below the FICA wage base). Both the S corporation and employee save the 7.65% FICA and Medicare taxes on the wages not reported.

IRS finds widespread noncompliance by colleges and universities

The IRS published its final report concerning its Colleges and Universities Compliance Project, finding compliance issues related to unrelated business taxable income (UBTI) and compensation practices. The IRS conducted the study to find out why colleges and universities had so much unrelated business activity but owed so little tax and to examine their compensation practices. The IRS examined tax returns from 34 colleges and universities it selected from among 400 it surveyed by questionnaire. The examined schools were divided almost evenly between private and public institutions, with about two-thirds reporting enrollments greater than 15,000 students.

Unrelated business taxable income. An exempt organization, including exempt colleges and universities, must pay tax on income from an unrelated trade or business, defined as an activity not substantially related to the accomplishment of the organization’s exempt purposes, even if the income from the business is used to support those purposes. Losses from one activity can offset income from another; however, continuing losses can indicate a lack of profit motive, which would disqualify the activity’s losses from the netting process.

The IRS found that UBTI was underreported at 90% of the institutions examined, with a total understatement of more than $90 million from 30 unrelated activities. The majority of the activities with unreported UBTI were fitness and recreation centers, sports camps, advertising, facility rentals, arenas, and golf courses. Nearly half of the institutions had adjustments to UBTI from advertising and/or facility rentals, and about one-third had adjustments from fitness and recreation centers and sports camps, arenas, and/or golf courses. The report identified four primary reasons for understated UBTI: (1) lack of profit motive, (2) improper expense allocation, (3) misclassification of certain activities as exempt, and (4) miscalculated or unsubstantiated net operating losses.

Nevada Corporate Income Tax

A California superior court has issued a temporary and proposed statement of decision holding that a Nevada corporation was entitled to a refund of California corporation franchise taxes paid for the tax years in question because the corporation met its burden of proof in establishing that it was commercially domiciled in Nevada during those years. The corporation, which was incorporated in Nevada, did not rely upon any presumption that its commercial domicile was its place of incorporation. The corporation submitted evidence that it maintained its corporate office in Nevada, its bank accounts were held at a branch in Las Vegas, its brokerage accounts were maintained with an office in Las Vegas, its board of directors’ meetings were held at its office in Nevada, and its original books and records were maintained in Nevada. Also, its only corporate officer resided in Nevada and handled all of its expenditures and business affairs from Nevada. The Franchise Tax Board (FTB) contended that a California resident, the corporation’s sole shareholder and a member of its board of directors, in fact managed and directed the corporation from California, and that therefore the corporation was commercially domiciled in California. However, the FTB submitted no direct evidence to support its contention. Furthermore, both the corporate officer and the sole shareholder testified that decisions on corporate matters were made by the officer and that the shareholder relied on the officer to manage the corporation. The court found the testimony of both witnesses to be credible. In contrast, the FTB’s evidence consisted entirely of circumstantial evidence from which it had asked the court to infer that the sole shareholder was directing or managing the affairs of the corporation from California. The tentative decision will become the final Statement of Decision unless either party requests a Statement of Decision, specifying the principal controverted issues to be addressed, within 10 days.